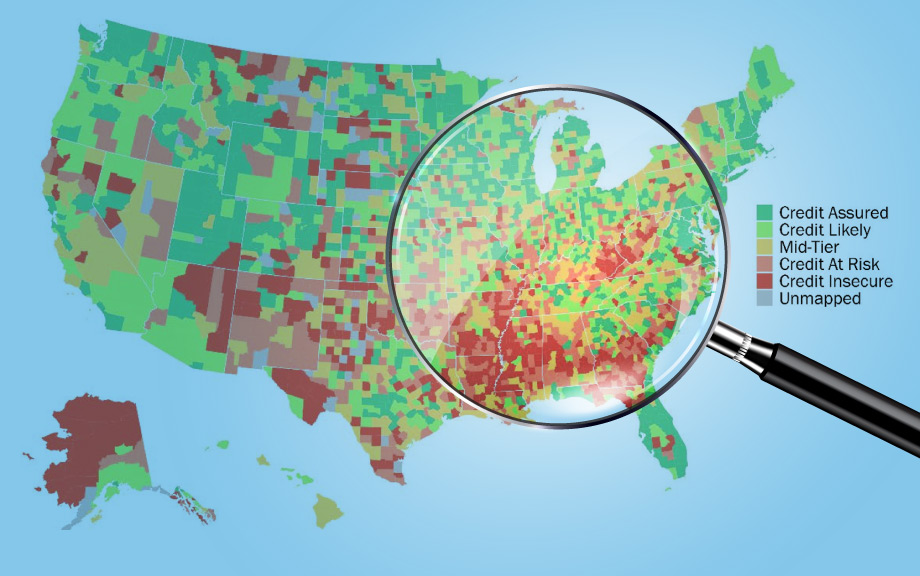

On Wednesday, April 16, 2025, the Federal Reserve Bank of New York hosted a virtual event to present findings of the report “Credit Insecurity in the United States: 2018–2023” and the recently updated Credit Insecurity Index. A panel of experts and practitioners discussed the issue of credit insecurity, the findings of the report, and the uses of the index as a tool in their work.

This event was of interest to academics, state and local government leaders, lenders, financial service providers, and leaders in community development, economic development, and nonprofits.

See the agenda for timing of specific conference segments.

April 16, 2025

1:00pm-2:15pm

This was a virtual-only event.

This event was open to the public.

This event was open to the media. All remarks were on the record, with the recording to be made available afterwards. For media inquiries, please contact Ellen Simon at Ellen.Simon@ny.frb.org

Agenda

| 1:00pm-1:05pm | Welcoming Remarks (00:00:08)

Claire Kramer Mills, Director of Community Development Analysis, Federal Reserve Bank of New York |

| 1:05pm-1:35pm | Presentation: Findings from “Credit Insecurity in the United States: 2018 – 2023” (00:01:41)

Claire Kramer Mills, Director of Community Development Analysis, Federal Reserve Bank of New Yorkk Ambika Nair, Community Development Analyst, Federal Reserve Bank of New York Jake Scott, Community Development Analyst, Federal Reserve Bank of New York |

| 1:35pm-2:10pm | Panel Discussion: Applications of the Credit Insecurity Index in a Community Context (00:18:38)

Moderator: Claire Kramer Mills, Director of Community Development Analysis, Federal Reserve Bank of New York Kelly Thompson Cochran, Deputy Director and Chief Program Officer, FinRegLab Dara Duguay, Chief Executive Officer, Credit Builders Alliance Angela Rollins, Director of Mayor’s Office of Financial Empowerment, City of Rochester |

| 2:10pm-2:15pm | Closing Remarks (01:11:24)

Claire Kramer Mills, Director of Community Development Analysis, Federal Reserve Bank of New York |