Measuring the Natural Rate of Interest

The Laubach-Williams and Holston-Laubach-Williams models provide estimates of the

natural rate of interest, or r-star, and related variables. Their approach defines r-star as the real short-term

interest rate expected to prevail when an economy is at full strength and inflation is stable.

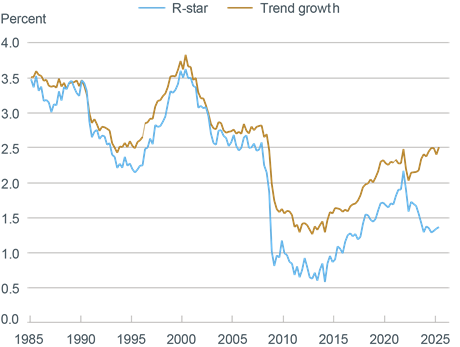

LW Estimates for the United States

Source: Laubach and Williams (2003).

Note: We plot estimates of the natural rate of interest (r-star) along with those for the trend growth rate of the U.S. economy, a source of change driving r-star.

Note: We plot estimates of the natural rate of interest (r-star) along with those for the trend growth rate of the U.S. economy, a source of change driving r-star.

The Laubach-Williams (2003) model uses data on real GDP, inflation, and the federal funds rate to extract trends in U.S. economic growth and other factors influencing the natural rate of interest. Holston, Laubach, and Williams (2023) adapts the model following the COVID‑19 pandemic.

Download Data Series and Code for LW Estimation

Real-time estimates (based on vintage data)

Current model estimates (previously labeled "updated estimates"; data include parameter estimates)

Replication code for COVID-adjusted LW Model

(current; as of December 29, 2025)

Current model estimates (previously labeled "updated estimates"; data include parameter estimates)

Replication code for COVID-adjusted LW Model

(current; as of December 29, 2025)

Archived Materials

Replication code for LW (2003) model

(as of November 1, 2019)

Notes on the August 31, 2018, estimates

Adapting the Laubach and Williams and Holston, Laubach, and Williams Models to the COVID‑19 Pandemic (May 27, 2020)

Notes on the August 31, 2018, estimates

Adapting the Laubach and Williams and Holston, Laubach, and Williams Models to the COVID‑19 Pandemic (May 27, 2020)

References

Cho and Williams. 2025.

"Comparing Apples to Apples: 'Synthetic Real-Time' Estimates of R-Star,"

Liberty Street Economics, March 3.

Holston, Laubach, and Williams. 2023. “Measuring the Natural Rate of Interest after COVID‑19,” Federal Reserve Bank of New York Staff Reports, no. 1063, June.

Laubach and Williams. 2003. “Measuring the Natural Rate of Interest,” Review of Economics and Statistics 85, no.4 (November): 1063-70.

Working paper version: “Measuring the Natural Rate of Interest”

Holston, Laubach, and Williams. 2023. “Measuring the Natural Rate of Interest after COVID‑19,” Federal Reserve Bank of New York Staff Reports, no. 1063, June.

Laubach and Williams. 2003. “Measuring the Natural Rate of Interest,” Review of Economics and Statistics 85, no.4 (November): 1063-70.

Working paper version: “Measuring the Natural Rate of Interest”

Release Schedule

Released at or shortly after 2:00 p.m.

2025

Feb 28

May 30

Aug 29

Dec 29

2026

Feb 27

May 29

Aug 27

Nov 27

2025

Feb 28

May 30

Aug 29

Dec 29

2026

Feb 27

May 29

Aug 27

Nov 27

Note:

The New York Fed does not offer individualized services to readers, such as custom charts or analysis.

The replication code zip files shared above contain programs to run the LW and HLW estimation using input data series provided in the "current model estimates" spreadsheet. Consult the code guides in the zip packages as well as the scholarly references on this web page for information on the data series used to run the models and their sources.

The Laubach-Williams and Holston-Laubach-Williams estimates were previously published on the Federal Reserve Bank of San Francisco’s website. No aspects of the methodology changed when publication moved to the Federal Reserve Bank of New York. See our “Notes” summarizing the effects of the 2018 National Income and Product Account (NIPA) revisions on our estimates of r-star and related variables above.

How to cite this report: Federal Reserve Bank of New York,

Measuring the Natural Rate of Interest, https://www.newyorkfed.org/research/policy/rstar/overview.

Contact: research.publications@ny.frb.org

The replication code zip files shared above contain programs to run the LW and HLW estimation using input data series provided in the "current model estimates" spreadsheet. Consult the code guides in the zip packages as well as the scholarly references on this web page for information on the data series used to run the models and their sources.

The Laubach-Williams and Holston-Laubach-Williams estimates were previously published on the Federal Reserve Bank of San Francisco’s website. No aspects of the methodology changed when publication moved to the Federal Reserve Bank of New York. See our “Notes” summarizing the effects of the 2018 National Income and Product Account (NIPA) revisions on our estimates of r-star and related variables above.

How to cite this report: Federal Reserve Bank of New York,

Measuring the Natural Rate of Interest, https://www.newyorkfed.org/research/policy/rstar/overview.

Contact: research.publications@ny.frb.org

Disclaimer:

The Laubach-Williams and Holston-Laubach-Williams estimates are not official forecasts of the Federal Reserve Bank of

New York, its president, the Federal Reserve System, or the Federal Open Market Committee.

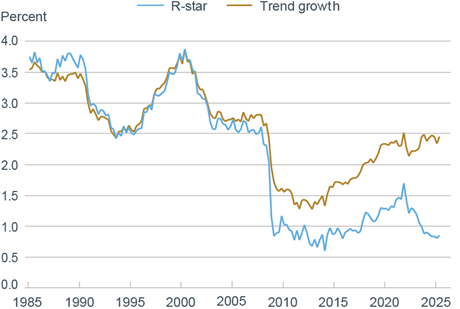

HLW Estimates for the United States

Source: Holston, Laubach, and Williams (2017).

Note: We plot estimates of the natural rate of interest (r-star) along with those for the trend growth rate of the U.S. economy, a source of change driving r-star.

Note: We plot estimates of the natural rate of interest (r-star) along with those for the trend growth rate of the U.S. economy, a source of change driving r-star.

The Holston-Laubach-Williams (2017) model extends this analysis to other advanced economies,

estimating r-star and related variables for the United States, Canada, and the Euro Area.

The Holston-Laubach-Williams (2023) model accounts for time-varying volatility and incorporates a

persistent supply shock during the COVID‑19 pandemic. Estimates for all three economies are shown in the HLW Estimates

tab linked above.

Download Data Series and Code for HLW Estimation

Real-time estimates

Current model estimates

Replication code for HLW (2023) model

(current; as of December 29, 2025)

Current model estimates

Replication code for HLW (2023) model

(current; as of December 29, 2025)

Archived Materials

Replication code for HLW (2017) model

(as of November 1, 2019)

Adapting the Laubach and Williams and Holston, Laubach, and Williams Models to the COVID‑19 Pandemic (May 27, 2020)

Measuring the Natural Rate of Interest: Past, Present, and Future (May 19, 2023)

Adapting the Laubach and Williams and Holston, Laubach, and Williams Models to the COVID‑19 Pandemic (May 27, 2020)

Measuring the Natural Rate of Interest: Past, Present, and Future (May 19, 2023)

References

Cho and Williams. 2025.

"Are Financial Markets Good Predictors of R-Star?",

Liberty Street Economics, August 25.

Cho and Williams. 2025. "Comparing Apples to Apples: 'Synthetic Real-Time' Estimates of R-Star," Liberty Street Economics, March 3.

Holston, Laubach, and Williams. 2023. “Measuring the Natural Rate of Interest after COVID‑19,” Federal Reserve Bank of New York Staff Reports, no. 1063, June.

Holston, Laubach, and Williams. 2017. “Measuring the Natural Rate of Interest: International Trends and Determinants,” Journal of International Economics 108, Supplemental 1 (May): S39–S75.

Working paper version: “Measuring the Natural Rate of Interest: International Trends and Determinants”

Cho and Williams. 2025. "Comparing Apples to Apples: 'Synthetic Real-Time' Estimates of R-Star," Liberty Street Economics, March 3.

Holston, Laubach, and Williams. 2023. “Measuring the Natural Rate of Interest after COVID‑19,” Federal Reserve Bank of New York Staff Reports, no. 1063, June.

Holston, Laubach, and Williams. 2017. “Measuring the Natural Rate of Interest: International Trends and Determinants,” Journal of International Economics 108, Supplemental 1 (May): S39–S75.

Working paper version: “Measuring the Natural Rate of Interest: International Trends and Determinants”

Release Schedule

Released at or shortly after 2:00 p.m.

2025

Mar 3

Jun 2

Sep 2

Dec 12 / Dec 29

2026

Mar 2

Jun 1

Aug 28

Nov 27

2025

Mar 3

Jun 2

Sep 2

Dec 12 / Dec 29

2026

Mar 2

Jun 1

Aug 28

Nov 27

By continuing to use our site, you agree to our Terms of Use and Privacy Statement. You can learn more about how we use cookies by reviewing our Privacy Statement.