|

On March 31, 2021, the authorization for the CPFF to purchase eligible commercial paper expired as scheduled and the CPFF closed. On July 8, 2021, the legal existence of the dedicated funding vehicle established to purchase eligible commercial paper was terminated. The materials and information on the web pages associated with this facility will remain available.

|

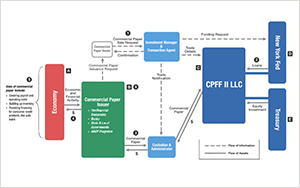

The CPFF provided a liquidity backstop to U.S. issuers of commercial paper through a dedicated funding vehicle that purchased eligible three-month unsecured and asset-backed commercial paper from eligible issuers using financing provided by the Federal Reserve Bank of New York. The vehicle held the commercial paper until maturity and used the proceeds from maturing commercial paper and other assets of the vehicle to repay its loans from the New York Fed.

On March 31, 2021, the authorization for the CPFF to purchase eligible commercial paper expired as scheduled and the CPFF closed. As of that date, the CPFF owned no commercial paper.

On June 29 and July 7, 2021, the dedicated funding vehicle established to purchase commercial paper (CP Funding Facility II LLC) made its final distributions of assets to the U.S. Department of the Treasury and the New York Fed. It returned the full equity investment of $10 billion to the Treasury (plus amounts earned through the investment of that capital) and sent residual profits of $49.1 million to the Treasury and New York Fed at the 90:10 ratio set out in the vehicle’s limited liability company agreement.

On July 8, 2021, the legal existence of CP Funding Facility II LLC was terminated.

- Registration Materials

- CPFF Dealers

- Frequently Asked Questions

- Program Terms and Conditions

- Competitive Procurement Process for Certain Vendor Roles Supporting Emergency Lending Facilities and Programs

On March 22, 2020, the New York Fed retained Pacific Investment Management Company, LLC (PIMCO) as a third-party vendor to serve as investment manager for this facility. PIMCO was selected on a short-term basis for this role after considering its knowledge and experience in the commercial paper market and in credit risk management and its operational and technological capabilities.

On March 25, 2020, the New York Fed retained State Street Bank & Trust Company (State Street) as a third-party vendor to serve as the custodian and accounting administrator for this facility. State Street was selected on a short-term basis for this role after considering its operational capabilities, as well as operational synergies stemming from its preexisting relationship with PIMCO.

Quarterly reports on the costs associated with the vendors supporting this facility are available in Vendor Information.

- Administration Agreement

(Updated July 8, 2021) - Control Agreement

- Credit Agreement

(Updated July 8, 2021) - Custodian Agreement

(Updated July 8, 2021) - Investment Management Agreement

(Updated April 19, 2021) - Investment Memorandum of Understanding

- Legal Services Engagement Letter

- Legal Services Engagement Letter

- Limited Liability Company Agreement

(Updated July 8, 2021) - Preferred Equity Investments Agreement

- Security Agreement

- State Street Fee Letter