The Federal Reserve Bank of New York, in cooperation with the U.S. Department of the Treasury’s Office of Financial Research (OFR), publishes three Treasury repo reference rates based on transaction-level data collected under the supervisory authority of the Board of Governors of the Federal Reserve System and the authority of the OFR. The New York Fed is proposing two modifications to the calculation methodology of SOFR. Both of the proposed changes involve the treatment of transactions within the centrally-cleared Delivery-versus-Payment (DVP, also known as bilateral) segment of the repo market, which is the largest of the three market segments incorporated into the calculation of SOFR. Since this segment is only used in the calculation of SOFR, these proposed changes will have no impact on the Tri-party General Collateral Rate (TGCR) or Broad General Collateral Rate (BGCR). The New York Fed proposes to implement these changes to the SOFR calculation by Q1 2025.

The first proposed change is to remove transactions between affiliated institutions. The New York Fed excludes such transactions “when relevant and when the data to make such exclusions are available.” The transition to using OFR’s collection of centrally-cleared repo in the production of SOFR now provides the counterparty data necessary to assess affiliation in the centrally-cleared DVP segment.

The second proposed change is to adjust the mechanism applied to mitigate the influence of "specials" transactions. Due to changes in the distribution of centrally-cleared DVP repo activity, the current mechanism has recently introduced greater variability in the transaction volumes incorporated into SOFR.

The New York Fed proposes to make these two adjustments to the calculation methodology to ensure that SOFR continues to reflect its underlying interest. The updated methodology does not result in notable changes in volumes or rates when applied to historical data.

Prior to January 24, 2022, the data now collected under the OFR’s authority were sourced from DTCC Solutions LLC, an affiliate of the Depository Trust & Clearing Corporation, under a commercial agreement. To date, the switch to OFR data has only impacted the means by which the data for the General Collateral Finance (GCF) and centrally-cleared DVP repo market segments are collected; the calculation methodology and composition of the Treasury repo reference rates have remained unchanged. However, the OFR data include greater transactional detail, offering the opportunity to identify transactions between affiliated entities in the centrally-cleared DVP repo segment.

The New York Fed proposes to refine SOFR’s methodology by removing transactions between affiliated entities from the centrally-cleared DVP segment. Such transactions have been excluded from the tri-party data provided by the Bank of New York Mellon (BNY) since SOFR’s launch in 2018, and such transactions are not relevant to the GCF market segment since all trades there are blind-brokered. As is the case in the conventional tri-party repo segment, transactions will be excluded on a "best efforts" basis, where neither of the affiliated institutions appears to be acting in a fiduciary capacity, and these exclusions will be applied prior to the application of the mechanism for mitigating the influence of "specials." There has been limited affiliate trading in the centrally-cleared DVP segment to date and eliminating such trades does not have a notable impact on SOFR when applied to historical data.

In the DVP repo market, counterparties identify specific securities to settle each trade, rather than a population of acceptable collateral as in the tri-party repo market. As a result, the DVP repo market can be used to temporarily acquire specific securities. Repo transactions for specific-issue collateral may be executed at rates below those for general collateral repos when cash providers are willing to accept a lesser return on their cash in order to obtain a particular security. In this case, the specific securities are said to be trading "special".

SOFR provides a broad measure of the general cost of financing Treasury securities overnight, and is not limited to Treasury general collateral repo activity, but an effort is made to reduce the influence of "specials" on SOFR's published rate via a trim of the transaction-level data. All DVP repo transactions with rates below the 25th volume-weighted percentile rate in the centrally-cleared DVP segment are trimmed, removing some (but not all) transactions in which the specific securities are said to be trading "special." This mechanism does not result in the removal of exactly 25 percent of the DVP data each day. In removing all transactions below a rate threshold, the share of overall DVP repo activity removed can vary from day to day.

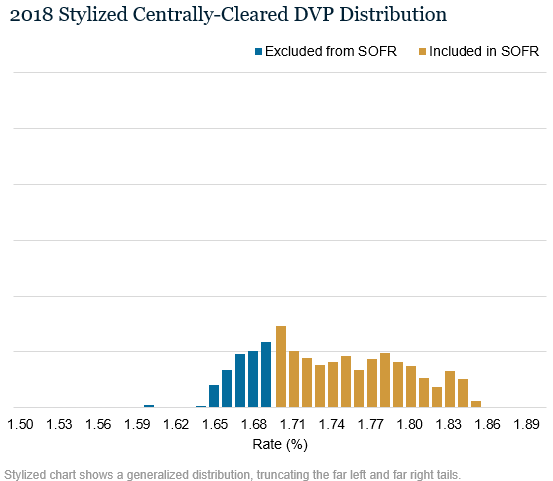

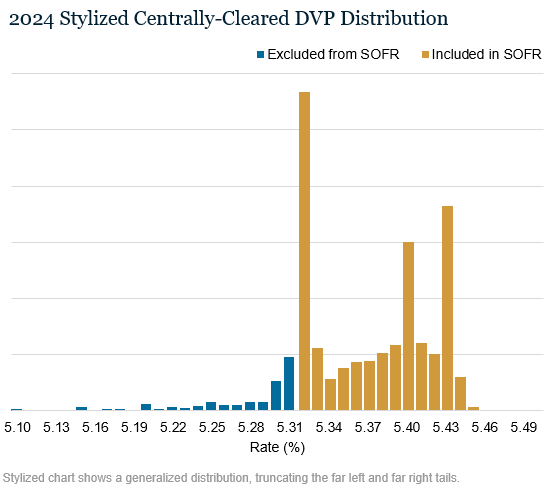

For much of SOFR’s history, the trimmed volume varied between 20 and 25 percent of DVP transactions. However, with the expansion of central clearing, the distribution of DVP activity across rates has changed, leading to multiple discrete modes (i.e. large volumes of transactions occurring at the same or very similar rates at specific areas of the broader distribution). The charts below juxtapose stylized examples of the rate distribution in 2018, around the time of SOFR’s launch, and 2024.

This change in the distribution has impacted where the 25th volume-weighted percentile lands in the overall DVP distribution and how much volume occurs at that rate. As noted in the chart above for 2024, the 25th volume-weighted percentile rate can occur around a mode in the distribution. When there is a significant proportion of volume at the 25th volume-weighted percentile rate, this volume is not trimmed out of SOFR because only the activity below the 25th-volume-weighted percentile rate is removed, resulting in a relatively small share of centrally-cleared DVP volume trimmed. Conversely, when the 25th volume-weighted rate falls just above a local mode, a relatively large share of DVP volume can be trimmed. This can cause greater variations in the share of overall DVP activity trimmed from day to day, which may also impact the SOFR print on some occasions. More recently the percent trimmed has experienced more variability, falling to as low as 7 percent of volume in the segment.

Instead of removing all transactions at rates below the 25th volume-weighted percentile rate of the overall centrally-cleared DVP distribution, the New York Fed proposes a mechanism that removes a consistent 20 percent of the lowest-rate transactions from the centrally-cleared DVP distribution.1

A consistent trim, calibrated to 20 percent, should accomplish the following:

- eliminate the day-to-day variability in the share of DVP activity removed from the calculation;

- result in SOFR published rates that, on average, are in line with the published SOFR rates with the current mechanism;

- effectively balance the risks of potentially including “specials” activity and removing activity that is occurring at rates similar to general collateral repos; and

- ensure that SOFR remains a robust benchmark in anticipation of more repo activity moving into central clearing in advance of the June 2026 deadline to comply with the Securities and Exchange Commission (SEC)’s rule requiring central clearing.

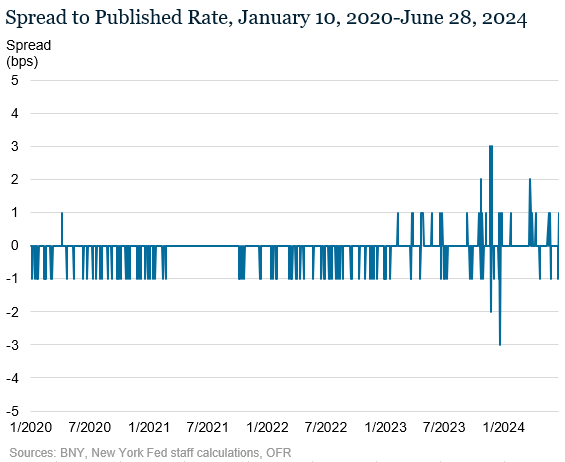

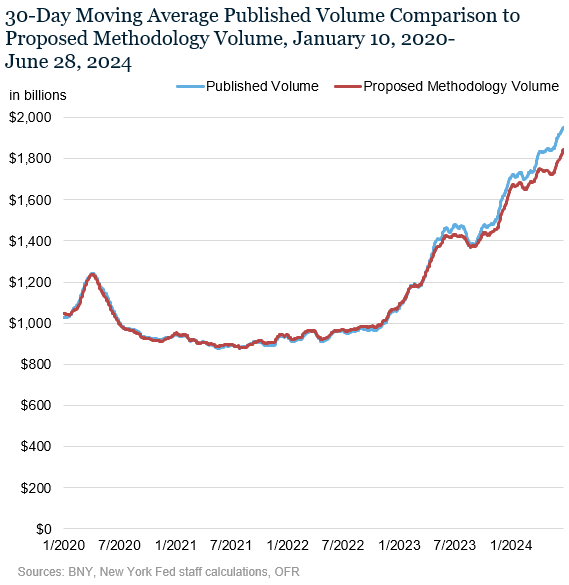

The figures below demonstrate how SOFR would have printed if the proposed changes were in place since January 2020.2 The rate would have been the same approximately 93 percent of the time, while the volumes would also have been very similar to currently published volumes. Indicative rates and volumes incorporating the proposed changes, which should not be considered official values, can be found here.

The contingency methodology used to calculate SOFR in the event that data for a given market segment are unavailable will not change as a result of these adjustments.

Data Collection

No new data collection will be required. Additional information about SOFR and other Treasury Repo Reference Rates can be found here.

IOSCO Compliance

The design of the Repo Reference Rates and their underlying data are assessed on a regular basis, and, in line with IOSCO Principles for Financial Benchmarks (the IOSCO Principles), can be modified in the case of market evolution to ensure they continue to accurately reflect their underlying interest.

SOFR is in compliance with the IOSCO Principles, and as has been long-noted, "As a reference rate administrator, the New York Fed may seek to revise the composition or calculation methodology for one or more of the reference rates it administers in response to market evolution or for some other reason." With this in mind, the modifications outlined in this proposal will enable SOFR’s calculation methodology to evolve with the changing market, so that SOFR remains in compliance with the IOSCO Principles in the long run.

In implementing these modifications, the New York Fed will endeavor to adopt policies and procedures consistent with best practices for financial benchmarks, to the extent appropriate, so that SOFR will remain compliant. For more information about how SOFR complies with the IOSCO Principles, please see the New York Fed’s Statement of Compliance.

Consistent with the IOSCO Principles and in accordance with its reference rates public consultation policy, the New York Fed requests comments on the above proposal. Comments should be submitted to the New York Fed by September 16 via email to rateproduction@ny.frb.org. Specifically, the New York Fed asks for responses to the following questions:

- Do you agree that affiliated transactions should be removed from the centrally-cleared DVP segment, given affiliated transactions are already removed from the BNY tri-party data?

- Do you agree with removing a consistent 20 percent of the lowest-rate DVP transactions from the centrally-cleared DVP segment for the reasons outlined in this proposal?

- Are there any additional considerations that you would like to highlight regarding the impact of planned or potential evolution of the Treasury repo market on SOFR?

As previously noted in the New York Fed’s public consultation policy, the New York Fed anticipates that it will publish individual comments received during this public consultation as well as a summary response to those comments when it issues the final notice. The New York Fed plans to post comments with attribution unless respondents request anonymity.