Today, I will discuss some of the differences between safe and money-like assets, with a focus on the central bank’s unique ability to produce money-like assets. I will highlight the risks that can accompany the private provision of money-like assets and describe how regulation and supervision can mitigate many of these risks. I will then examine how the central bank could complement regulation and supervision in mitigating these risks by providing overnight money-like assets, with a focus on changes in the Federal Reserve’s liabilities in recent years. As always, the views presented here are my own and do not necessarily reflect those of the Federal Reserve Bank of New York or the Federal Reserve System.1

Money-Like Assets versus Safe Assets

Money-likeness and safety, although closely related, are not completely overlapping concepts.2 Safety refers to an asset’s lack of actual and perceived exposure to risk, including credit risk, counterparty risk, interest-rate risk, and market risk.3 Money-likeness refers to an asset’s lack of information sensitivity, such that, when it is used in transactions, economic agents need not worry about its future value, at least in the short term and in most states of the world.4 Because of this, money-like assets are usually short-term, liquid assets with no credit or counterparty risk, promising a fixed payment in nominal terms.5

In normal states of the world, investors tend not to distinguish too carefully between and among money-like and safe assets. However, in non-normal states of the world, where investors have heightened perceptions of risk—partly because of underlying credit or counterparty issues, but also critically because of uncertainty about the actions of other investors—investors tend to view directly-held liabilities of the official sector as substantially safer than those of the private sector.

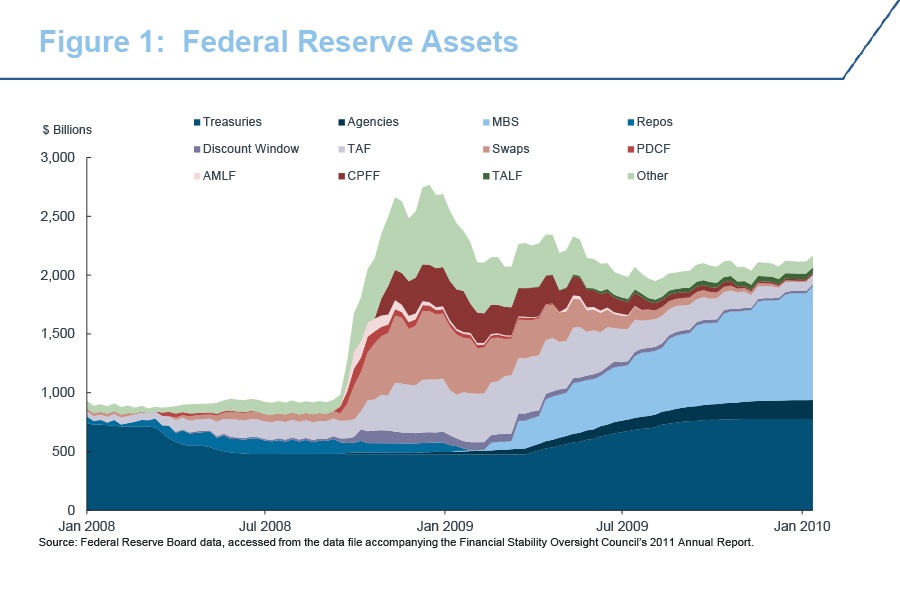

In these non-normal states of the world, central banks have the unique ability to quickly produce large quantities of assets that are both safe and money-like. Central banks can provide liquidity to the private sector and reduce systemic risk in the economy by providing credit that is secured by less-liquid assets.6 This “lender of last resort” capacity is particularly important when the precautionary demand for liquidity increases substantially, because it is precisely at these times that private provision of liquidity declines. The financial crisis of 2008 provides a striking example of this ability. As shown in Figure 1, the Federal Reserve doubled the size of its balance sheet in a matter of weeks in September 2008 to meet the extraordinary demand for liquidity as private sources of liquidity dried up.

On the liability side of the Federal Reserve’s balance sheet, the increase in liquidity was matched by increases in bank reserves and Treasury deposits through this extraordinary period.7 The Treasury deposits were funded by an increase in bill issuance, hence the amount of officially-produced, safe and money-like assets in the financial system increased by around $1 trillion in a few weeks.8

Of course, since investors are aware of the central bank’s unique ability to quickly supply safe and money-like assets in non-normal times, their incentives to monitor risks in normal times may be reduced. The moral hazard raised by this awareness may be addressed through regulation and supervision. Further, the central bank needs to take care that its provision of money-like assets in normal times does not crowd out the private financial system or exacerbate run behavior in stressful times.9

Private Provision of Money-like Assets

The private sector plays an important role in the provision of money-like assets. For instance, banks create money-like assets in the form of bank deposits.Similarly, nonbank institutions, such as money market funds (MMFs), can also provide money-like assets.

However, private provision of money-like assets can increase the risk of financial instability. In order to provide money-like assets, financial institutions generally engage in maturity and liquidity transformation, transforming longer term assets into callable liabilities that are runnable.10 Thus, although in normal times investors may perceive these privately produced assets as safe and liquid, a sudden shift in investor perceptions can amplify instability in periods of market stress. To the extent that the private sector does not incorporate the social cost of runs on private callable liabilities, too much private money can be created in normal times, generating a role for public sector intervention.

The main way the public sector can mitigate the risks associated with the excessive private supply of money-like assets is through regulation and supervision. By reducing the fragility of financial institutions, regulation reduces the run externalities associated with private money creation. Effective capital regulation and supervision are the main tools for reducing investor concerns about the banking system’s solvency in stressful times. In addition, FDIC deposit insurance complements strong capital by reducing depositors’ incentives to run on banks.

Following the financial crisis, the regulatory and supervisory framework has been extended to more directly reduce risks from swings in the supply of liquidity within the financial system. In particular, the Liquidity Coverage Ratio (LCR) reduces the likelihood of runs by forcing banks to hold highly liquid assets against expected future cash outflows.11,12

Example of Money Fund Reform

Runs can also occur on nonbanks. One particularly spectacular run during the financial crisis followed Lehman’s bankruptcy and the Reserve Fund’s “breaking the buck” as investors fled prime money market funds. This run was stopped dramatically by a government guarantee. Recent work by some New York Fed colleagues provides a real-world example of how, in normal times, new regulation can induce investors to distinguish between safe and money-like assets.13 They used the Securities and Exchange Commission’s (SEC) recent implementation of measures to reform the MMF industry as a quasi-natural experiment to characterize investors’ preferences for money-like assets.14

In 2014, the SEC approved a new set of rules aimed at mitigating the fragility of prime MMFs. As of October 2016, prime funds have been required under certain conditions to impose liquidity fees on redemptions or gates halting the redemption of shares.15 Additionally, prime funds offering shares to institutional investors may no longer price such shares with fixed NAVs; instead, they must price their shares at the market value of the underlying securities, much like standard mutual funds. By requiring prime MMFs to adopt a system of gates and fees, the reform made them less money-like; floating NAVs reduced the money-likeness of the institutional sub-segment even further.16,17

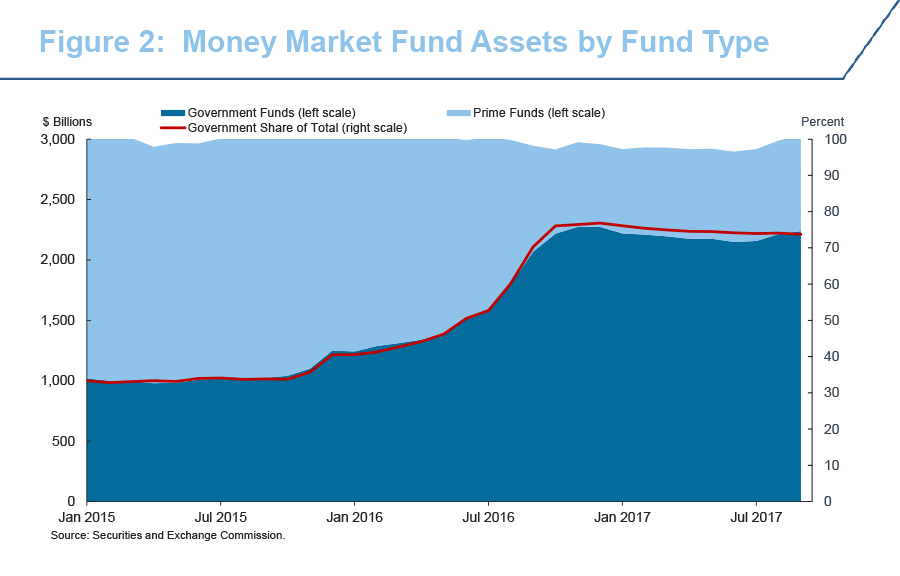

The differential impact of the SEC’s MMF reforms—which made prime MMFs less money-like yet not riskier—can be used to distinguish between investors' preferences for money-likeness and safety in normal states of the world. Figure 2 shows the industry’s aggregate assets around the implementation of the new rules. In anticipation of implementation, more than $1 trillion flowed from the prime MMF sector into the government MMF sector.18

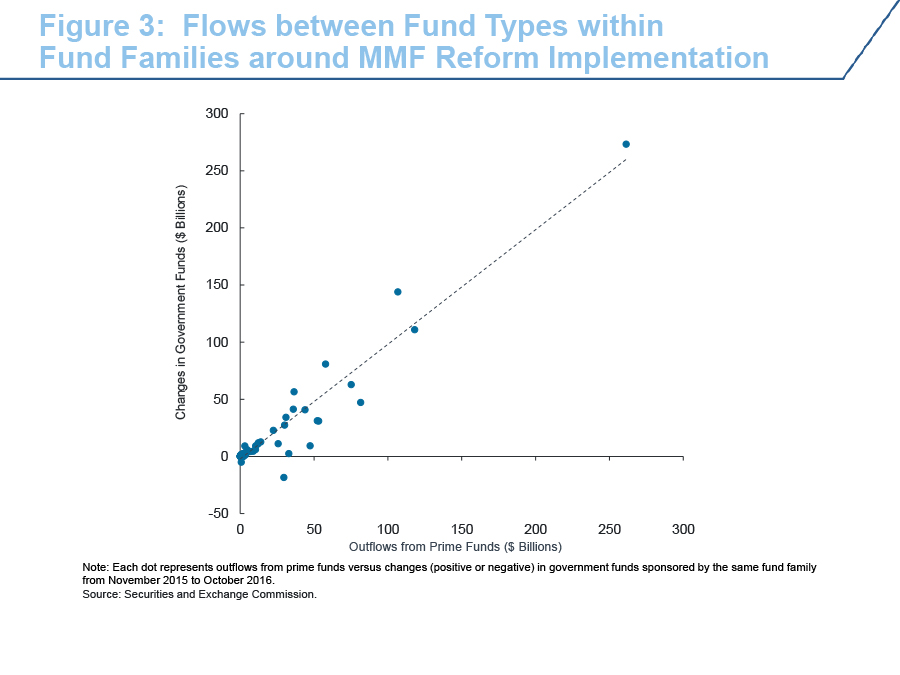

Moreover, the absence of other changes in investors’ behavior suggests that MMF investors were driven by a narrow desire to preserve the money-likeness of their investments. When moving from prime to government MMFs, investors largely remained in the same fund family. Figure 3 illustrates this observation using a scatter plot of outflows from prime funds versus inflows into government funds at the family level. Additionally, investors shifted into funds that invest primarily in agency debt, the sub-segment of the government MMF industry with a risk-return profile most similar to that of prime MMFs.

This response to MMF reform differs significantly from what happened in 2008. Although during the 2008 MMF run, investors also fled from prime to government MMFs, the characteristics of the run differed substantially: outflows were large but quickly reverted following the guarantee; they largely occurred across—and not within—fund families as investors became wary of particular counterparties; and investors moved to the safest sub-segment of the government MMF industry, that is, funds investing only in Treasuries and Treasury-backed repos.19 These contrasts further illustrate a difference between investors’ demand for money-like assets in normal times, when regulation changes, and their demand for safety in non-normal times.

Public Sector Provision of Money-Like Assets

There is a view that regulation and supervision alone are not sufficient to fully mitigate the financial stability risks associated with private maturity and liquidity transformation, and thus, the official sector should consider providing more money-like assets.20 The argument is that when the official sector increases its supply of money-like assets, it reduces the convenience yield on very short-term securities, thereby weakening the private sector’s incentives to create short-term runnable securities.21 Some recent market pricing helps to illustrate this characteristic. As shown in Figure 4, an increased supply of bills issued by the U.S. Treasury in late 2017 was accompanied by a tightening of the spread between rates on 3-month T-bills and overnight indexed swaps (OIS)—a spread between two risk-free instruments that can be thought as reflecting the premium associated with bills’ money-like characteristics in normal times.22

While this is an area worthy of further research, I personally am not compelled by the notion that the public sector can calibrate its supply of money-like assets at the short-end of the curve to exactly remove any remaining externalities from the private creation of money-like assets. In particular, for the last few years in the U.S., because of the various large-scale asset purchase programs, the provision of overnight money-like assets from the Federal Reserve has likely been in excess of investor demand; however, spreads between rates on money-like assets have remained, and in some cases become more variable and larger. This suggests that other forces are in play. One such force is the adjustment of the financial industry to the new regulatory landscape. It is important that the private sector make this adjustment to better align incentives. The role of the central bank’s provision of money-like assets is to ease and support this adjustment, not substitute for it. This is especially true given that private-sector balance sheets are now less elastic in the short-run with respect to fluctuations in the demand and supply of money-like assets.

Federal Reserve Provision of Overnight Money-Like Assets

Even without expressly pursuing a financial stability objective, a central bank’s balance sheet can provide safe and money-like assets to a wide range of financial institutions in normal times.23 The October 2008 introduction of the Federal Reserve’s ability to pay interest on reserve balances and the 2013 development of an overnight reverse repo (ON RRP) facility provided critical tools that allow the Federal Reserve to maintain control of overnight interest rates regardless of the size of its balance sheet.24 This ability is important because, before the crisis, the Federal Reserve could not increase the supply of its money-like liabilities in normal times without compromising monetary policy objectives.25

Figure 5 shows the size of selected liabilities of the Federal Reserve before the crisis, in December 2017, and market participants’ estimates for average 2025 levels.26 Before the crisis, the Federal Reserve’s provision of money-like liabilities other than currency was negligible to ensure control of overnight rates in the operating system used at that time. Reserves were kept scarce in the banking system, and other liabilities—such as the Treasury’s account at the Fed and overnight investments by foreign central banks—were kept very limited, with tight control around their daily variation. In the current operating system, Federal Reserve’s non-currency overnight liabilities are substantial and allowed to vary considerably to accommodate supply and demand shocks in the private sector.27

Currently, reserves in the banking system are abundant, with possible benefits for the efficiency and safety of the wholesale payment system.28 The estimates for 2025 indicate an expectation that reserves will decline substantially, but still remain many orders of magnitude above their pre-crisis level. Market contacts focus on the demand for reserves produced by the LCR as an important driver of this change. Banks that satisfy their LCR requirements with large reserve balances free up other high-quality liquid assets for the rest of the private sector.

Overnight reverse repos with foreign central banks—who seek safe and money-like dollar assets to maintain liquid dollar foreign currency reserves—have grown substantially in the last few years. Part of this increase was likely a reflection of latent demand that was relieved as restrictions on these investments were relaxed,29 but part of it also represents new regulations that make it more expensive for the private sector to hold large deposits that are callable at any time.

A new category of liability is the ON RRP facility, which is available to nonbanks.30 In addition to supporting interest rate control, this facility helps the private sector adjust smoothly to various new regulations. For example, during the money fund reform period, as money flowed from prime to government funds, prime funds used the facility to become more liquid in advance of redemptions and government funds used it to temporarily absorb new investments.31

Finally, the Treasury General Account (TGA) has grown substantially in recent years as the U.S. Treasury has decided to hold a precautionary buffer of cash generally sufficient to cover five business days of outflows, subject to a minimum balance of $150 billion. Given the daily variability of TGA balances, this type of account would be also expensive for the private sector to offer under new regulations. Further, as the buffer has been funded mainly through increased bill issuance, it has increased the supply of money-like assets to the private sector.

Conclusion

Central banks are uniquely able to produce money-like assets that are viewed as safe during non-normal times. In more normal times, regulation and supervision are the best tools to mitigate risks from the private creation of money-like assets, but there is a role for the central bank to use its balance sheet to smooth fluctuations in the supply and demand for money-like assets.