Welcome to the 2019 Annual Primary Dealer Meeting. Each of your firms plays an important role as a trading counterparty in the implementation of monetary policy—a core responsibility of the Federal Reserve Bank of New York as the operating arm for the Federal Open Market Committee (FOMC). This is an area that has generated increased operational activity over the past year. These annual meetings provide us an opportunity to strengthen our relationship and communicate the New York Fed’s expectations of its counterparties.

Over the course of the year, there have been important developments in the Federal Reserve’s framework for implementing monetary policy, and the markets in which we operate have continued to evolve. I’d like to focus today on what the New York Fed’s Open Market Trading Desk (the Desk) is currently doing to implement the FOMC’s ample reserves regime, particularly over the next several months. In mid-October, the FOMC directed the Desk to maintain over time ample reserve balances at or above the level that prevailed in early September, and we recently began Treasury bill purchases to achieve that objective. Since it will take some time to accumulate securities holdings, we also continue to conduct temporary repurchase agreement (repo) operations in order to ensure that the supply of reserves remains ample and to mitigate the risk of money market pressures that could adversely affect policy implementation. Although money market conditions have calmed since the mid-September volatility, the Federal Reserve is carefully monitoring reserves conditions and money market developments, and the Desk will continue to use its tools and adjust operational plans as needed to maintain the federal funds rate in the FOMC’s target range.

In addition to discussing open market operations today, I would also like to focus briefly on another key development in money markets—the transition away from LIBOR. I will highlight today’s announcement about the New York Fed’s proposal to produce averages for the Secured Overnight Financing Rate (commonly known as the SOFR).

Before I begin, I will remind you that the views presented here are mine alone and do not necessarily reflect those of the New York Fed or the Federal Reserve System.1

Open Market Operations in an Ample Reserves Regime

I’d like to start with some context about how the FOMC planned its transition to an ample reserves operating regime for monetary policy implementation.

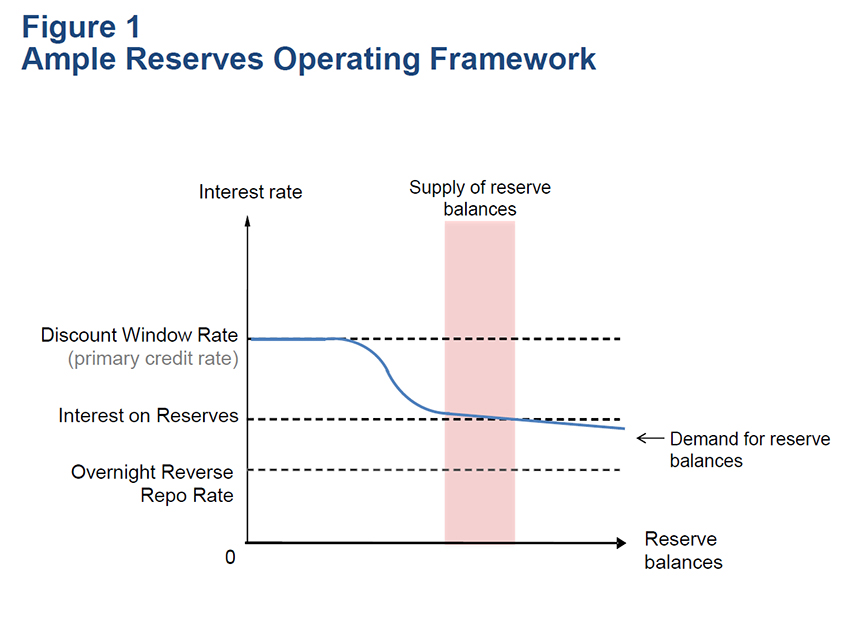

In January, the FOMC announced its intention to continue implementing monetary policy using an ample reserves operating regime. This means that the supply of reserves is sufficient to ensure that control over the federal funds rate and other short-term interest rates is exercised primarily through the Federal Reserve’s administered rates, and active management of the supply of reserves is not required.2 This last clause is an important feature of the framework and means that, over time, the level of reserves will be large enough to absorb short-term changes in factors affecting the supply of reserves without the need for frequent, sizeable interventions to offset these changes (Figure 1).

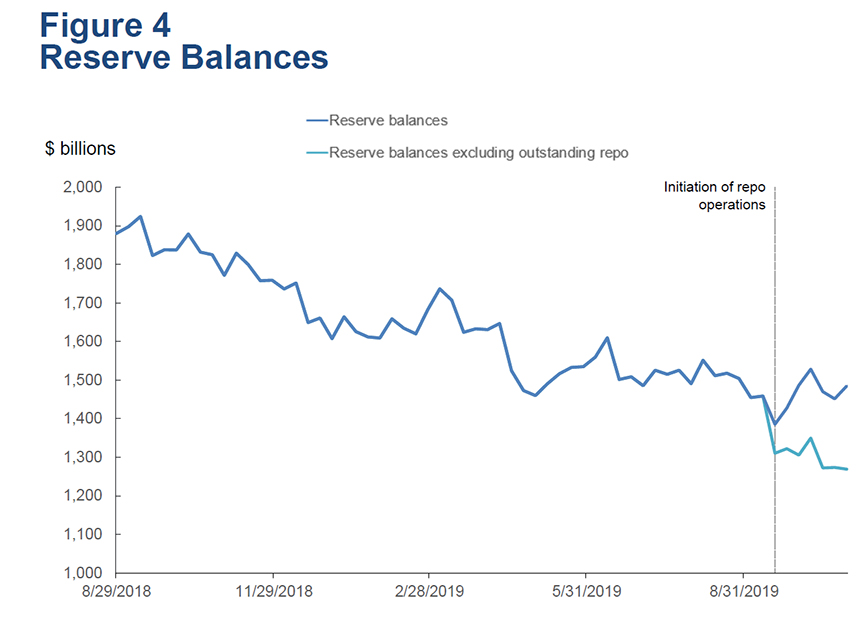

In March, the FOMC indicated that the longer-run level of reserves will be a level consistent with “efficient and effective” implementation of monetary policy.3 To support a smooth transition to the longer-run level of reserves, the FOMC also stated its intention to slow the pace of the decline in reserves—which had been coming down as a result of normalizing the balance sheet—over subsequent quarters, first by slowing and then by stopping the reduction in the Federal Reserve’s aggregate securities holdings. The end of balance sheet runoff occurred in August, and the FOMC continued to monitor a wide range of information to reach a judgement about the level of reserves most consistent with efficient and effective policy implementation in an ample reserves regime.4

In mid-September, upward pressure emerged in funding markets as corporate tax payments and the settlement of Treasury securities increased demand for securities financing and sharply reduced reserves in the system. Consistent with the directive from the FOMC, the Desk responded with temporary open market operations to foster conditions that would maintain the federal funds rate within the target range. In mid-October, the FOMC directed the Desk to maintain over time reserve balances at or above the level that prevailed in early September in order to ensure that the supply of reserves remains ample.5 The FOMC judged this level more supportive of smooth market functioning and effective control over the federal funds rate, and we have seen money market pressures stabilize.

It’s worth noting that the quantity of reserves needed to maintain an ample reserves framework is subject to uncertainty and may change over time. Banks’ demand for reserves is not static. It shifts in response to changing financial conditions and will evolve through time as banks adjust their business models and respond to changes in the economic and regulatory environment. In addition, the level of reserves needed to maintain an ample reserves regime is more than the sum of individual banks’ reserves demand, particularly when there are frictions that result in inefficient redistribution of reserves. The measurement of these factors is complex, and the FOMC will continue to monitor a broad range of information to assess the level of reserves consistent with efficient and effective implementation of policy.

I’d like to turn now to how the Desk will supply reserves to carry out the FOMC’s directive to maintain reserves over time “at or above” the level that prevailed in early September. This directive requires provision of a supply of reserves that can sufficiently absorb normal fluctuations in non-reserve liabilities, so shifts in these balances do not bring reserves below desired levels and potentially compromise effective interest rate control.

The Desk has been directed to purchase Treasury bills at least into the second quarter of next year to achieve the FOMC’s objective, and we are currently executing those reserve management purchases at the initial pace of $60 billion per month.6,7 I’d like to share some thoughts on the composition and sizing of those purchases.

First, why Treasury bills?

As I noted earlier, the goal of the reserve management purchases is to maintain an ample supply of reserves to support effective and efficient monetary policy implementation.

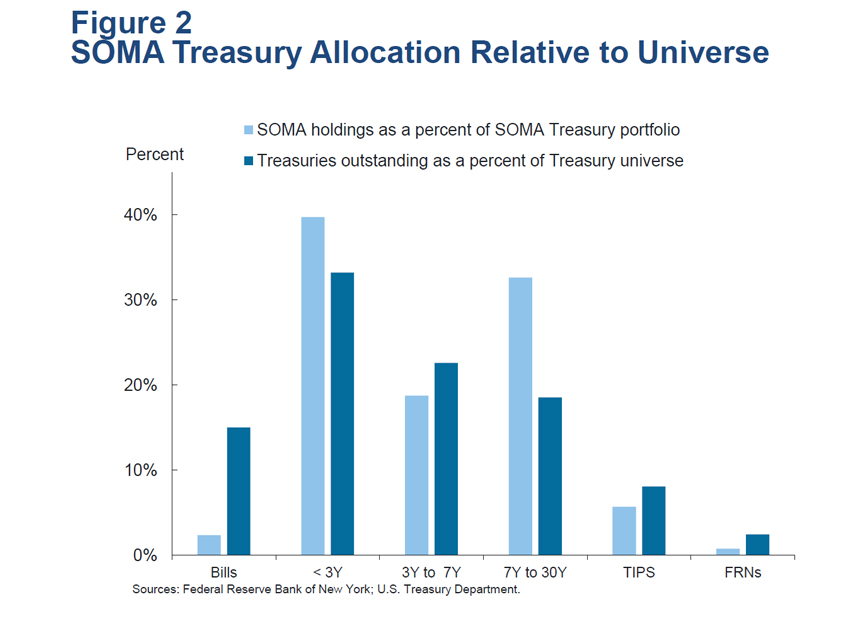

Because Treasury bills are short-dated instruments, purchases of these securities can help maintain the supply of reserves while limiting the impact on financial conditions. Moreover, bills are liquid instruments with deep markets, and the Federal Reserve doesn’t currently hold many of them. The Federal Reserve traditionally held a relatively large portfolio of Treasury bills (in addition to holdings across the coupon curve) in its System Open Market Account (SOMA), but sold or redeemed that bill portfolio during the Global Financial Crisis and in the Maturity Extension Program. While the FOMC has not yet made decisions about the long-run composition of its domestic securities portfolio, current bill holdings in the SOMA are low by any measure.8 Treasury bills represent less than 3 percent of the SOMA’s Treasury portfolio, compared to 15 percent of the outstanding Treasury universe (Figure 2). From a portfolio composition perspective, these purchases will incrementally add bills back to the portfolio as the FOMC continues to consider its desired long-run maturity composition.

Second, how do we approach the design of our purchases?

At present, three elements are driving the overall size of the reserve management purchases:

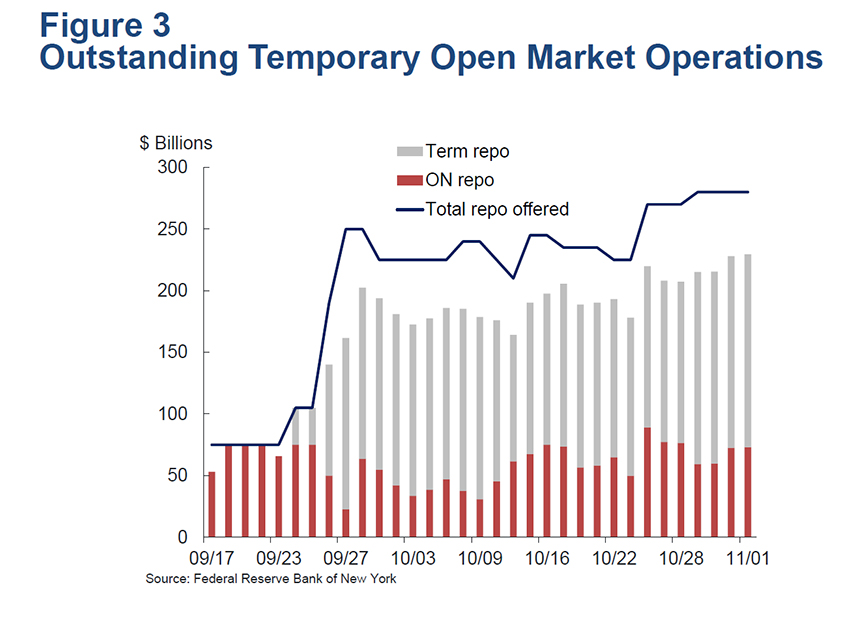

- First, reserve management purchases will replace over time the reserves that repo operations are currently supplying. In October, overnight and term repo operations together resulted in a daily average of around $190 billion in total repos outstanding (Figure 3). In the near term, these operations have boosted the supply of reserves and helped to mitigate the risk of money market pressures adversely affecting monetary policy implementation (Figure 4).

- Second, reserve management purchases will support expected gradual increases in demand for the Federal Reserve’s non-reserve liabilities, like currency in circulation, the Treasury General Account, the foreign repo pool, and other deposits. All else equal, growth of non-reserve liabilities will reduce reserves over time. Therefore, to maintain steady reserve levels, the Desk will offset the reserve-draining effects of growth in these liabilities through securities purchases—the same way Treasury purchases supported trend balance sheet growth before the crisis.9 Taken together, non-reserve liabilities currently add up to around $2.5 trillion. Currency in circulation is the largest and fastest growing of these—accounting for more than $1.7 trillion (or about seven-tenths) of the total, and growing at an average annual pace of over 6 percent in recent years (Figure 5). Offsetting currency growth alone will result in over $100 billion in purchases per year. However, other non-reserve liabilities have also exhibited trend growth over time, and additional purchases will account for this as well.

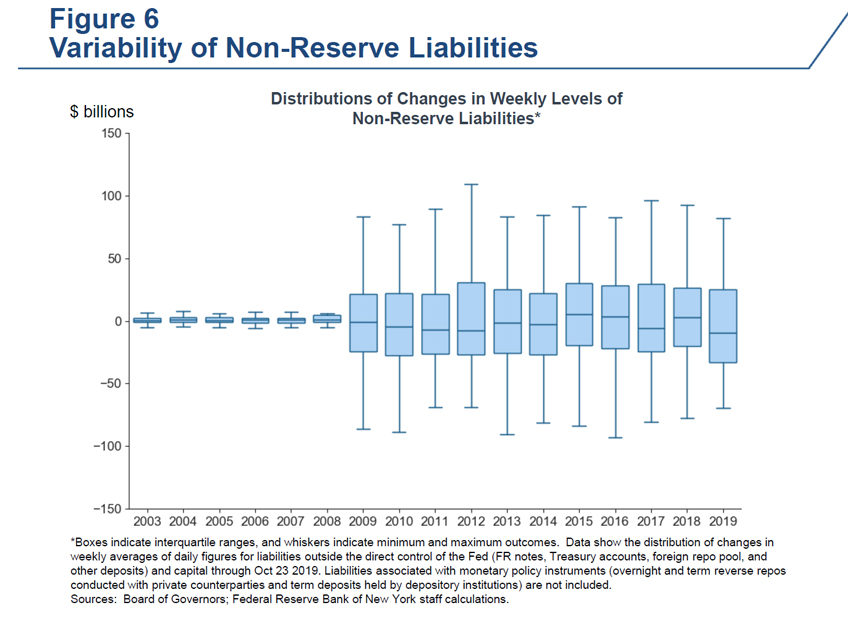

- Third, reserve management purchases will provide reserves to absorb normal variability or unexpected changes in the Federal Reserve’s non-reserve liabilities so reserves don’t fall below the level needed to operate the ample reserves framework. Figure 6 shows how variability in our non-reserve liabilities has grown in recent years. Balances in the Treasury’s General Account (TGA), in particular, fluctuate greatly from day to day. We saw that in September, when tax payment and Treasury settlement-related flows into the TGA reduced reserves by over $115 billion in the course of two days. In order to maintain reserve levels at or above those that prevailed in early September, reserves will be increased to a level that can absorb such variation when it occurs. Absent a sufficient supply, reserve balances could become too scarce, requiring large temporary open market operations to address funding pressures on days when there are large swings in reserves, like tax payment dates.

In practice, this will mean looking out over several months and sizing reserve management purchases to offset expected reserve declines. For example, reserve balances tend to decline notably in late April as the TGA grows with the collection of individual taxes, and the Desk’s planned purchases over the next several months will help to offset the anticipated decline in reserves associated with those flows.

Besides estimating the total amount of purchases, the Desk also needs to determine the pace at which it will execute those purchases. The amount and timing of the operations take into account market functioning considerations and allow for some adjustments around periods with sharp expected declines in reserves or liquidity conditions.

So far, reserve management purchase operations have proceeded smoothly. The Desk has purchased $52.5 billion of the initial $60 billion in monthly purchases, through seven purchase operations of roughly $7.5 billion each. To date, those operations have generated strong offer-to-cover ratios, pricing that has been favorable relative to market and theoretical prices, and broad participation and awards from your firms. Moreover, the Treasury bill market is accustomed to shifting amounts of securities available for purchase due to seasonal dynamics related to TGA inflows and outflows and the debt ceiling, and we’ve seen market prices adjust as we expected given the flow of our planned purchases. With roughly $2.4 trillion of Treasury bills outstanding and daily turnover of around $95 billion, the bill market has substantial capacity to support our activity, and we expect to be able to maintain the current pace of Treasury bill purchases for some time.10

That said, the Desk is prepared to adjust the pace and other parameters of the reserve management purchases as necessary to maintain an ample supply of reserves and based on money market conditions. We’ll be closely monitoring the attractiveness of propositions and indicators of market functioning to assess whether operational adjustments are appropriate.

In the meantime, because it will take some time for the bill purchases to sustain the supply of reserves at or above levels prevailing in early September, the FOMC has also instructed the Desk to continue offering term and overnight repo operations at least through January. Repo operations foster conditions to maintain the federal funds rate within the target range through two channels. First, they supply reserves in support of the FOMC’s operating regime, helping to ensure that reserves are maintained over time in amounts at or above the early September levels, even in the face of sharp increases in non-reserve liabilities.11 Second, they provide funding in repo markets to damp repo market pressure that could otherwise pass-through to the federal funds market and adversely affect policy implementation.

The repo operations have successfully offset supply changes and money market pressures associated with big anticipated drops in reserves, such as around mid-month and month-end settlements. In doing so, they have been effective at restoring calm in money markets and maintaining control over the federal funds rate. Overnight and term money market rates have moderated, on average, relative to IOER, and the effective federal funds rate has stayed well within the FOMC’s target range. Participation in the repo operations has been robust and the transmission to broader money markets has been good.

On October 23, the Desk announced an increase in the amount offered in overnight repo operations from at least $75 billion to at least $120 billion. We also increased the amount offered in the remaining term repo operations spanning the October month-end from at least $35 billion per operation to $45 billion, raising the total amount of term repos offered over this period to up to $180 billion. This increased capacity was supportive to money markets, and the federal funds rate was stable over October's month-end.

As we head into year-end, the Desk will continue to make adjustments as needed to mitigate the risk of money market pressures that could adversely affect policy implementation. It is good to see firms starting to address year-end funding needs, and we understand that, as firms manage their balance sheets more carefully in December, rates can be somewhat more variable and dealers may adjust their approach to our operations. We will monitor conditions closely and will be prepared to adapt open market operations as needed to meet the directives from the FOMC.

Averages of SOFR Rates and the Transition from LIBOR

Before I wrap up, I’d like to say a few words about reference rates. As I noted to this group last year, the New York Fed is committed to producing robust and resilient reference rates and to supporting the transition away from LIBOR.12 New York Fed President John Williams has emphasized this issue, noting that while progress has been made, there is still much work to do, and with no guarantee of LIBOR’s existence beyond the end of 2021, the clock is ticking.13

The New York Fed helps advance these objectives as the administrator and producer of the SOFR, which was selected by the Alternative Reference Rates Committee (ARRC) as its preferred alternative to U.S. dollar LIBOR, and also, in coordination with the Federal Reserve Board, through support of the ARRC. The SOFR, which launched in April 2018, is a measure of the general cost of borrowing cash overnight collateralized by Treasury securities in the repo market—a rate that broadly reflects how financial institutions fund themselves. Importantly, it reflects underlying transaction volumes averaging more than $1 trillion per day over the past year, and its production is compliant with IOSCO’s Principles for Financial Benchmarks. Over the past year-and-a-half, SOFR futures markets have demonstrated promising growth in notional volumes traded and liquidity, even if volumes remain low compared to both federal funds and Eurodollar futures. Additionally, there has been meaningful issuance of SOFR-linked cash products like floating rate notes.

A next step in supporting broader adoption of the SOFR as a LIBOR alternative will be to meet the need expressed by market participants—particularly financial and corporate issuers of securities and loans—for a set of SOFR averages that can be used in a wide range of financial products.14 To this end, today, the New York Fed released a solicitation for public comment on a plan to publish daily, starting in the first half of 2020, a set of three compounded averages of the SOFR, as well as a daily SOFR index that would allow users to calculate compounded averages over custom time periods.15

An expansion to the suite of reference rates we produce is an important next step that further demonstrates the Federal Reserve’s commitment to support the usefulness of adopting the SOFR. I also urge you to commit to this critical endeavor. The comment period for the public solicitation will close on December 4, and I encourage you to review the proposal and provide feedback, including about the tenors and compounding methodology for the new products. While the response to preliminary socialization of the program parameters has been positive, we recognize the importance of getting these averages right. Market participant feedback was critical as the New York Fed began producing Treasury repo reference rates to support the transition, and your continued input will help ensure that the rates we produce best meet the needs of the financial system. More generally, every market participant needs to understand their LIBOR exposures and use all available tools to transition to robust alternative rates, such as the SOFR, as they prepare for a world without LIBOR.

Conclusion

In sum, the Desk continues to operationalize the FOMC’s ample reserves regime. We are doing this by conducting Treasury bill purchases to maintain a supply of reserves consistent with the FOMC’s directive to maintain reserves at or above early-September levels. Also, since it will take some time to accumulate securities holdings to achieve that objective, the Desk is continuing to provide reserves temporarily through overnight and term repo operations. We are monitoring market conditions closely, have tools to effectively and efficiently support monetary policy implementation, and will make adjustments as needed. Both in the execution of open market operations and support for the transition from LIBOR, it is a very active time on the Desk, and our partnership with each of your institutions remains important to the smooth implementation of this work.