Introduction

Thank you for the invitation to speak at this SIFMA event.1 It is a pleasure to be back with you to discuss financial markets and monetary policy implementation. When I last spoke with this group in July of last year, I shared my views on the marked deterioration in conditions in the U.S. Treasury and agency mortgage-backed securities (MBS) markets at the onset of the COVID-19 pandemic, and the Federal Reserve's asset purchases undertaken to support market functioning.

Asset purchases are ongoing and continue to help foster smooth market functioning and accommodative financial conditions, supporting the flow of credit to households and businesses. This expansion in the Federal Reserve's assets also has the effect of increasing Federal Reserve liabilities—particularly reserve balances—which can have important implications for money markets. Today, I would like to discuss the recent rapid expansion in reserves, and its influence on money market conditions. I plan to share some perspective on how, in this environment, the Federal Reserve's tools will help maintain the federal funds rate well within the target range and support effective policy implementation.

Before I continue, let me note that the views I express today are my own, and do not necessarily reflect those of the Federal Reserve Bank of New York or the Federal Reserve System.

Reserves Rise to Historically High Levels

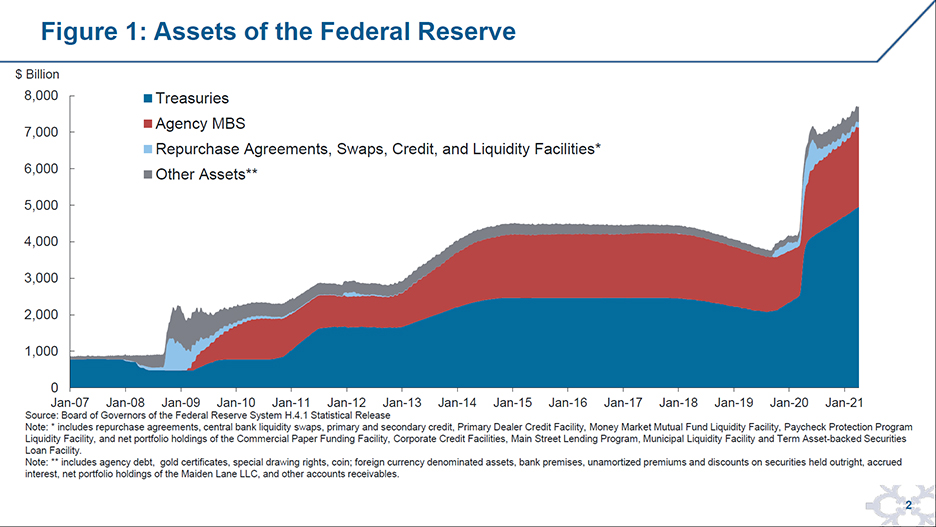

I'd like to start with some context on the historic nature of the changes in the Federal Reserve's balance sheet over the past year. Since the beginning of March 2020, the Federal Reserve's assets have grown from $4.2 trillion to $7.7 trillion, as shown in Figure 1, representing the largest increase over a similar timeframe in the Federal Reserve's history. This expansion reflects the FOMC's swift and decisive actions to address deteriorating conditions in financial markets and the severe economic downturn associated with the pandemic. As part of those measures, increases in holdings of U.S. Treasury securities, shown in dark blue, and agency MBS, shown in red, have supported smooth market functioning and helped to foster accommodative financial conditions.

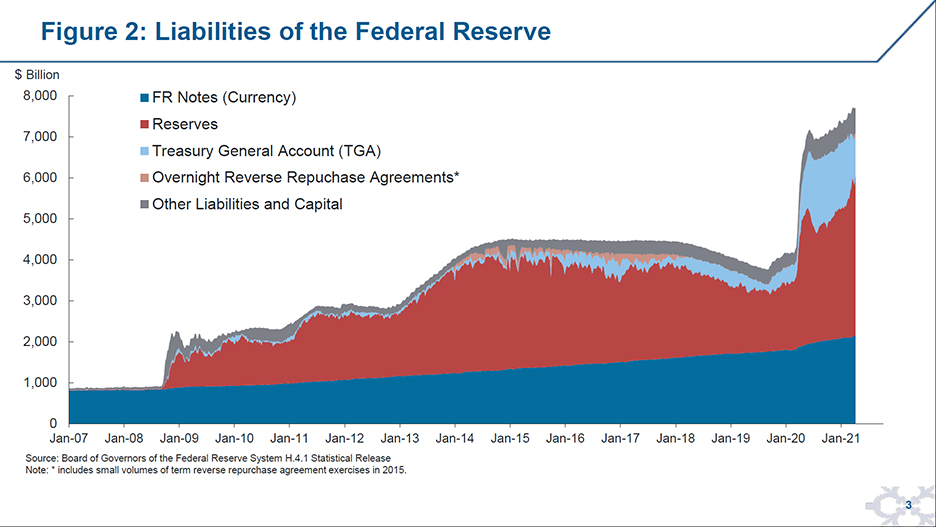

An increase in Federal Reserve assets is naturally accompanied by an increase in liabilities. As Figure 2 shows, the expansion in assets over the past year was primarily supported by increases in two types of liabilities: bank reserves, shown in red, and the Treasury General Account (TGA), shown in light blue.

The TGA is the U.S. Treasury's cash account with the Federal Reserve, and the U.S. government uses this account to make and receive payments. As the pandemic unfolded in 2020, the Treasury built up precautionary balances in this account to prepare for outflows associated with fiscal spending to address the economic downturn. This increase in the TGA limited growth in reserves that would have otherwise resulted from the Federal Reserve's balance sheet expansion. However, more recently, the Treasury began drawing down these precautionary balances and the TGA declined by over $600 billion in the first quarter. This reduction in the TGA, combined with ongoing asset purchases, has lifted reserves at an extraordinary pace in recent months; aggregate reserves reached an all-time high of $3.9 trillion on April 7, an increase of about $800 billion since the beginning of the year.

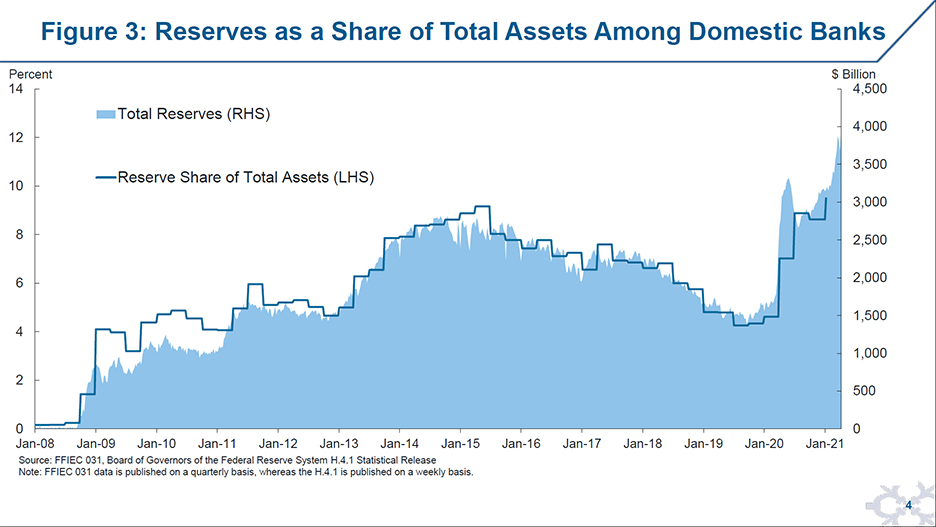

As of December, reserves held by domestic banks as a share of their total assets were at the highest level that we have observed, as shown by the dark blue line in Figure 3, and reserves have risen since then. As aggregate reserves grow, banks may perceive increasing costs associated with higher reserve balances and the resulting growth in their balance sheets. If so, individual banks may take actions to limit or manage these impacts, such as reducing wholesale funding, discouraging deposit inflows, or purchasing securities to reduce reserve holdings.2

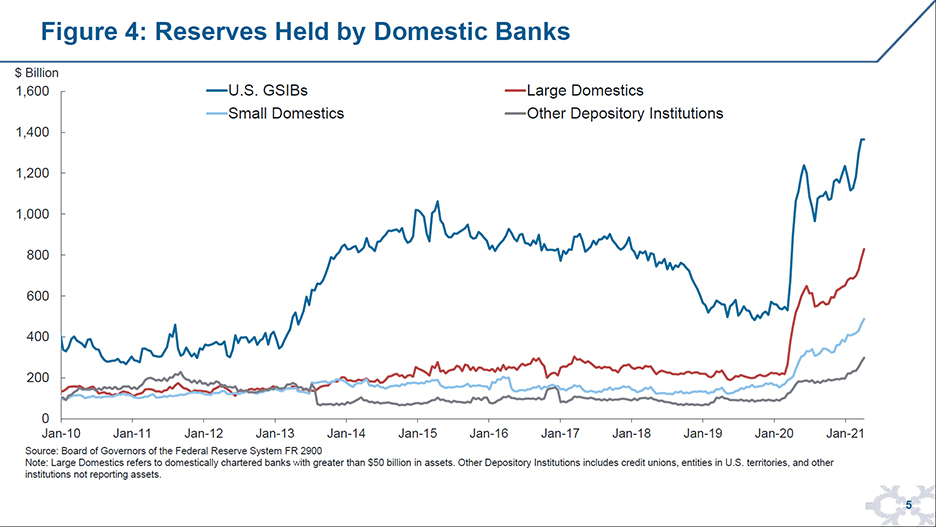

To date, reserve increases among domestic banks have been broadly distributed across firms of all sizes, as shown on the right-hand side of Figure 4. Some banks—global systemically important banks (GSIBs) and other large domestic banks, in particular—appear to be reducing reliance on certain types of wholesale funding and purchasing high quality securities to manage their balance sheets. However, much of the recent growth in reserves has been driven by deposit inflows that may be more challenging to moderate.

Although individual banks can take steps to limit growth in their own reserve balances, reserves in aggregate cannot fall unless they are absorbed by other Federal Reserve liabilities or Federal Reserve assets decline. The actions banks take to limit or manage reserve balances instead put downward pressure on money market rates relative to the interest paid on excess reserves (IOER) until the banking system is content to hold the aggregate supply of reserves.

Overnight Rates Have Fallen, but to Different Degrees

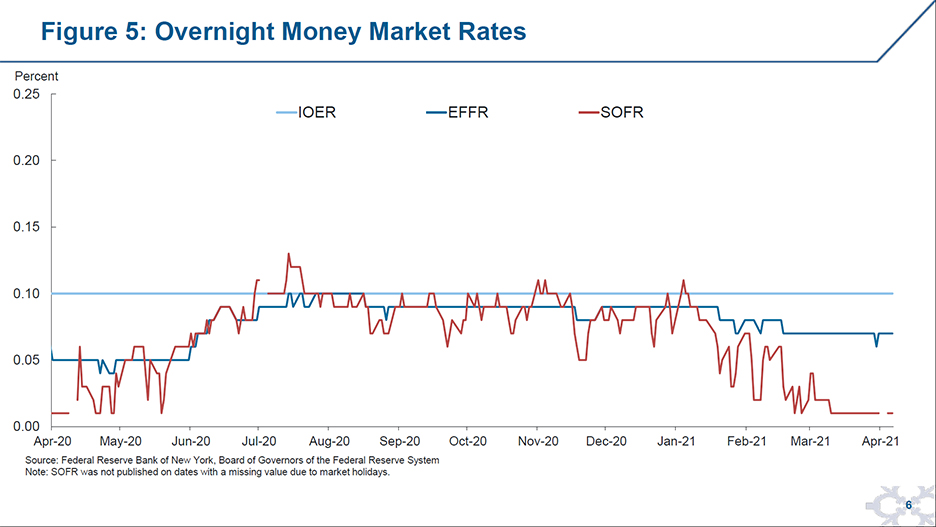

Even as reserves have risen to historic levels, the effective federal funds rate (EFFR) has remained relatively stable at around seven basis points, three basis points below IOER, as shown by the dark blue line in Figure 5. At the same time, overnight secured rates have fallen and the Secured Overnight Financing Rate (SOFR), shown in red, has declined to around one basis point.

What might account for this growing difference between unsecured and secured rates?

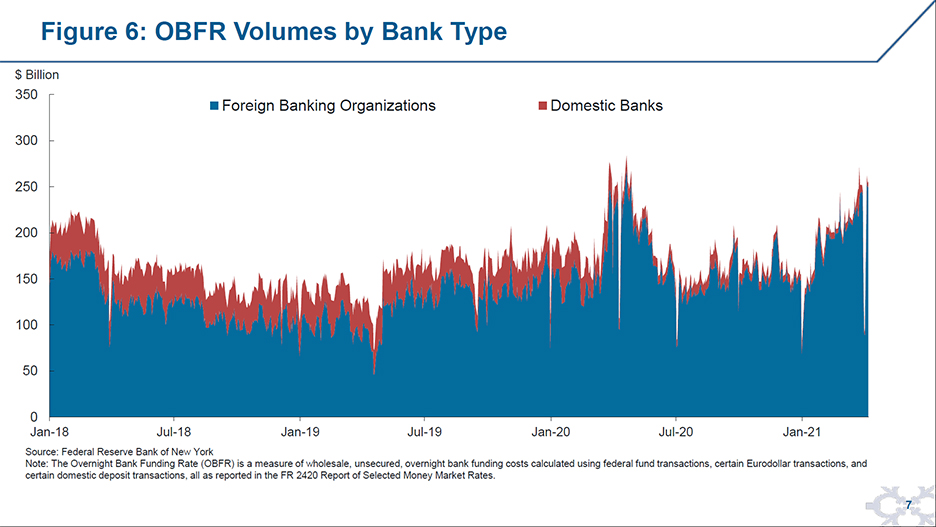

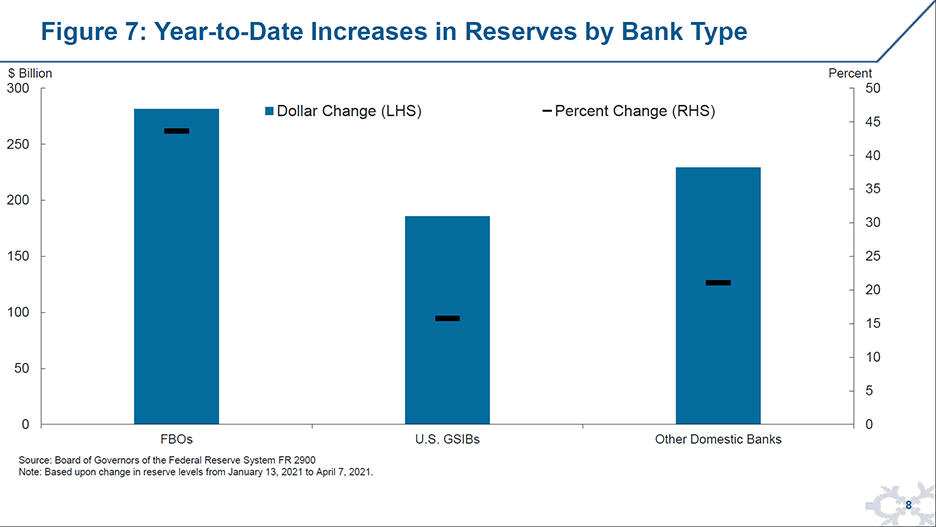

The resilience to date in overnight unsecured borrowing rates reflects, in part, foreign banking organizations' (FBOs) robust borrowing at rates relatively close to IOER. As shown in Figure 6, FBOs account for almost all activity that makes up the Overnight Bank Funding Rate (OBFR)—a broad measure of wholesale overnight unsecured rates—and their volumes have increased considerably in recent months. Alongside this growth in wholesale liabilities, FBO reserve balances have grown by roughly 45 percent since the beginning of the year, as shown in Figure 7. Our understanding is that these FBOs value their relationships with wholesale lenders and may face lower balance sheet costs than many domestic banks, and therefore have not demanded a wider spread below IOER to take on this funding.

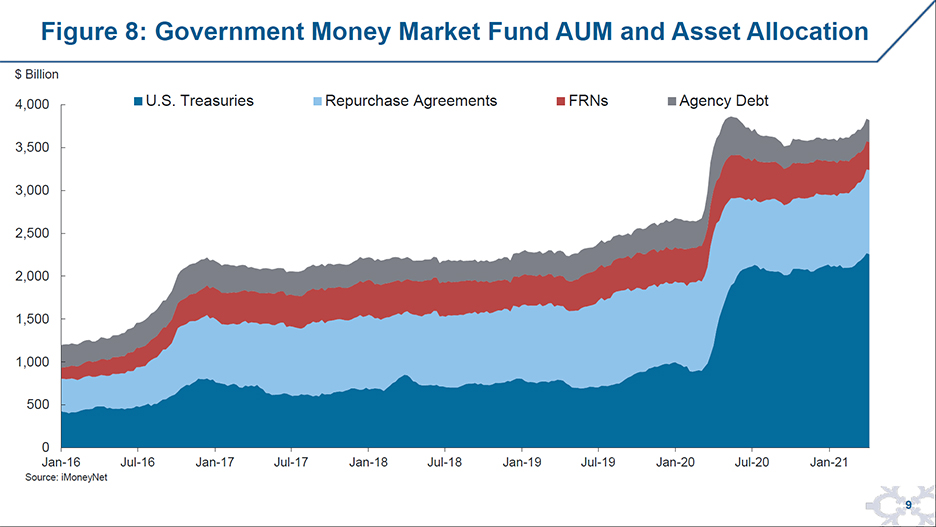

In contrast, reductions in U.S. Treasury bill supply and robust growth among secured money market investors has resulted in more pronounced downward pressure in overnight secured rates. In the year to date, the publicly available supply of Treasury bills has declined by around $300 billion. Meanwhile, as shown in Figure 8, government money market fund (MMF) assets under management (AUM), which are markedly higher since the pandemic began, have grown significantly since the start of the year. Investors view government MMFs as safe and highly liquid investments, and they become increasingly attractive as banks lower deposit rates or limit deposit growth.3

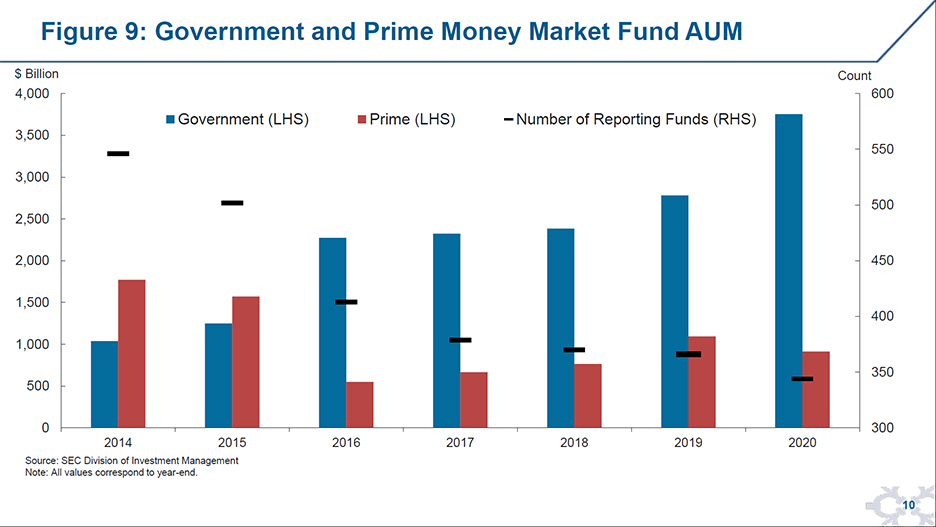

Historically, when significant differences emerge between secured and unsecured rates, we have seen investors—most notably prime MMFs—reallocate between these markets, moderating the rate spread. 4 However, prime MMFs have become much less prominent in recent years, as shown in Figure 9. It may be that, with investors somewhat more cautious after the stresses in money markets last spring, the yield earned on unsecured investments does not currently offer a sufficient premium to attract new investments into prime MMFs or for prime fund managers to take on additional liquidity risk with existing AUM.5 These factors may also be contributing to a slightly wider spread than we have observed in recent years.

Where might rates go from here?

Ultimately, the evolution of overnight rates will depend on the adjustment to higher reserve levels, and the supply and demand for overnight investments. As aggregate reserves continue to grow, banks may take additional actions to manage growth in their individual reserve balances.6 In previous periods of elevated reserves, FBOs absorbed a significant share of reserves through wholesale borrowing and, as I noted, recently we have seen growth in FBO balances. However, it remains to be seen if some FBOs will be comfortable taking additional reserve balances, and if so, whether it will require a wider spread below IOER for them to do so.

In an environment where banks are seeking to moderate growth in reserve balances, MMFs are also likely to see ongoing inflows, increasing the demand for short-term investments. To the extent that these inflows continue to go to government MMFs, secured rates may experience more downward pressure. The supply of government investments, including Treasury bills, will be an important factor influencing money market rates.

As rates adjust to rising reserves and changes in the supply and demand for overnight investments, we will be monitoring markets closely. We are confident that the Federal Reserve has the tools to maintain control over the federal funds rate and support effective policy implementation, a discussion I will turn to now.

The Federal Reserve's Tools Support Rate Control, with the ON RRP Facility Becoming More Central in the Framework

In January 2019, the FOMC communicated its intention to continue to implement monetary policy in a regime in which an ample supply of reserves ensures that control over the level of the federal funds rate and other short-term interest rates is exercised primarily through the setting of the Federal Reserve's administered rates.7,8 The payment of IOER sets a benchmark against which banks evaluate their lending and borrowing opportunities. In addition, the Federal Reserve offers a fixed-rate investment to a broad base of money market investors, known as the overnight reverse repo (ON RRP) facility, which establishes a floor for overnight rates below IOER. The availability of this facility as an investment option improves money market lenders' bargaining power in private markets. When investors use the facility, the reverse repo transactions and corresponding reduction in reserves broadens the liability base that supports asset purchases and alleviates the pressures on bank balance sheets that lower money market rates.

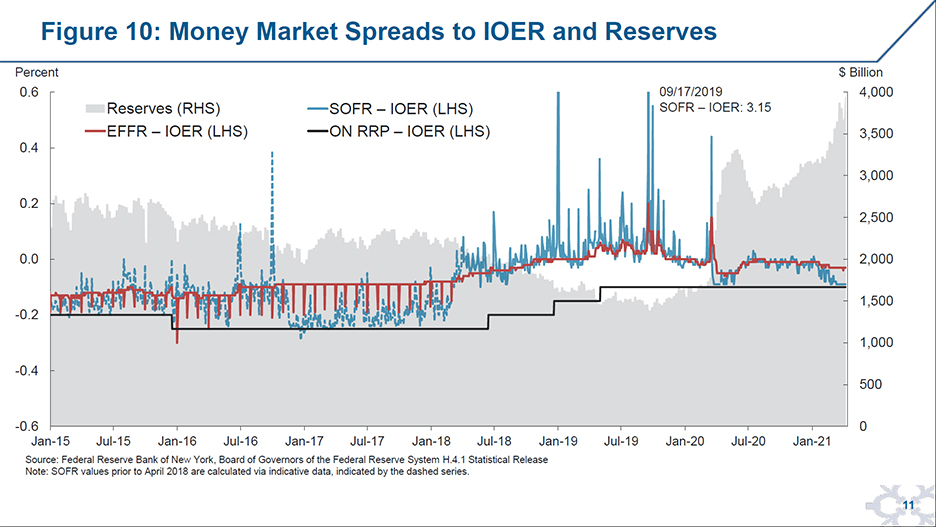

In an abundant reserves environment when overnight rates trade sufficiently below IOER, the ON RRP facility becomes a more central part of the implementation framework. Since its introduction, the ON RRP facility has been effective at providing a floor for the federal funds rate and limiting downward pressure on other overnight rates, as shown in Figure 10.9 Meanwhile, concerns about possible repercussions of the ON RRP facility that were discussed when it was established—such as the potential for investments to shift towards the facility in times of stress or for it to reshape the financial industry in unanticipated ways—have not materialized in the intervening years, even through various periods of market stress.10,11 Overall, the ON RRP facility has proven to be a highly effective tool for monetary policy implementation.

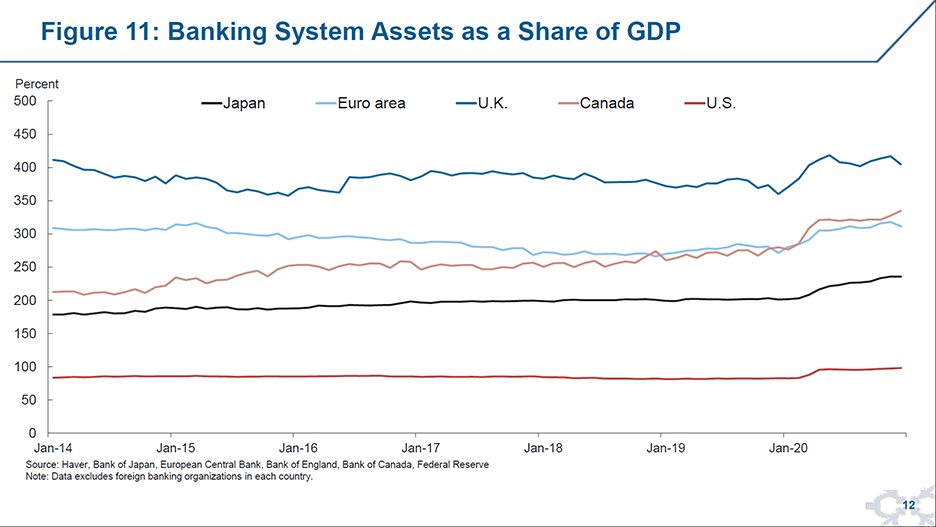

The availability of the ON RRP facility may be particularly important in the U.S. context. This is because the U.S. banking system is smaller relative to the overall size of the economy than in other advanced economies, as shown in Figure 11, and because non-bank entities represent a relatively larger proportion of the U.S. financial system. As a result, a given amount of asset purchases relative to gross domestic product may have a more significant impact on the U.S. banking system than it would on the banking systems in other countries. The ON RRP facility can continue to provide a floor on rates and broaden the set of holders of Federal Reserve liabilities beyond reserves held by banks.

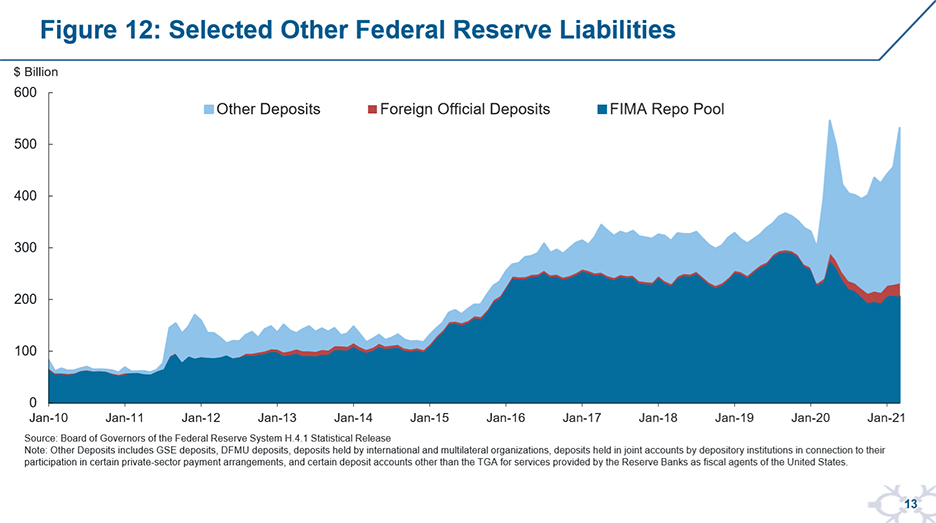

Ultimately, it is the price adjustments in money markets that will determine the mix of liabilities between reserves and the ON RRP facility.12 These price adjustments could also affect the mix of other Federal Reserve liabilities, although likely to a lesser degree. The Federal Reserve offers accounts and investments to certain official institutions and financial market utilities (FMUs). As money market rates decline, these entities may also increase their balances. As shown in Figure 12, some of these other liabilities have grown notably over the past year. For example, although still lower than in earlier years, Foreign Official and International Monetary Authority (FIMA) accounts have recently increased their reverse repo pool investments and unremunerated balances with the New York Fed, shown in dark blue and red, respectively.13 Other deposits with Reserve Banks, which primarily comprise accounts for Government Sponsored Enterprises (GSEs) and FMUs designated systemically important by the Financial Stability Oversight Council, have also increased materially.

An Update of ON RRP Terms Ensures it Supports Effective Policy Implementation

As a measure of prudent planning, the Open Market Trading Desk ("Desk") recently conducted a review of key design features of the ON RRP facility to ensure that the facility's terms continue to support effective policy implementation. We found that the existing ON RRP facility counterparty types—MMFs, GSEs and banks, as well as primary dealers—continue to cover the major investors in the tri-party repo market in which the Desk operates the ON RRP. However, the MMF industry has grown in size and has become more concentrated at the largest funds since the facility's $30 billion per-counterparty limit was set in 2014. In light of this evolution, the FOMC decided to increase the ON RRP facility per-counterparty limit to $80 billion in order to restore the capacity of the facility relative to the aggregate size of money fund counterparties to roughly the level that prevailed when the $30 billion limit was established. This should help ensure that the ON RRP facility maintains a floor for the federal funds rate and supports effective policy implementation. Related to this review, the Desk is planning in coming months to relax certain eligibility criteria that MMFs and GSEs, in particular, must meet in order to be eligible as ON RRP facility counterparties.14 These changes could reduce barriers to entry in the industry for smaller MMFs and promote a more fair and inclusive marketplace.

Since the most recent FOMC meeting, the facility has continued to serve as an effective floor even as greater downward pressure on overnight secured rates has emerged. There has been relatively modest take-up on most days as the ON RRP facility has bolstered money market lenders' bargaining power. Take-up at March quarter-end rose to $134 billion, and the ON RRP facility provided an outlet for investors on this date when financial firms managed their balance sheets more tightly.

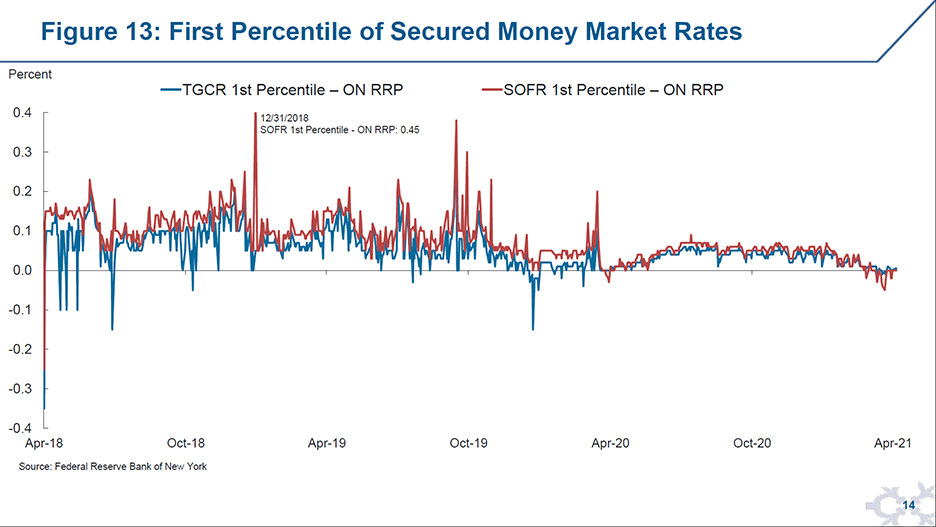

Since the facility's inception, we have periodically observed some repo trading at rates below the ON RRP offering rate, as shown in Figure 13 by the first percentiles of the Tri-party General Collateral Rate (TGCR) and SOFR. Recently some activity has occurred at rates below zero in interdealer markets, as captured in the SOFR first percentile. This appears to be technical in nature, driven in part by the value that dealers place on the ability to centrally clear these transactions and net their balance sheet exposures. Given these benefits, we understand that dealers who have access to the ON RRP facility are lending at modestly negative rates. Even as modest volumes occur at rates below the ON RRP rate, the facility continues provide an effective floor. However, we will continue to monitor money markets closely and make adjustments to ON RRP operations as needed.

Administered Rates Support Effective Policy Implementation

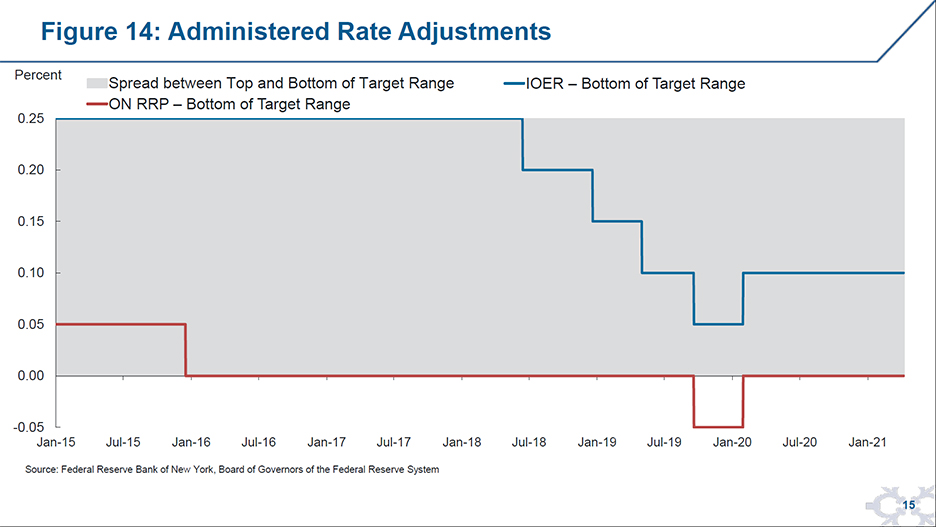

In addition to ensuring that the ON RRP’s facility's terms continue to support effective policy implementation, it might be appropriate to implement adjustments to administered rates should undue downward pressure on overnight rates emerge, as noted in the minutes of the March FOMC meeting released last week. The Federal Reserve has adjusted administered rates relative to the target range on numerous occasions in recent years as conditions in overnight markets have evolved, as shown in Figure 14. Such adjustments are purely technical steps to support effective policy implementation and to maintain the federal funds rate well within the target range.

Conclusion

In conclusion, the adjustment to higher reserve levels has important implications for money markets. I have been pleased that the FOMC's implementation framework continues to accommodate the adjustment to higher reserve levels resulting from the FOMC's actions to foster smooth market functioning and accommodative financial conditions.

Given the significant increase in reserves and reduction in Treasury bill supply since the start of the year, overnight money market rates have softened. With reserves expected to grow further, we will be monitoring money markets closely and will continue to make adjustments as needed.

In this environment, I am confident that the Federal Reserve's tools will continue to support effective policy implementation. IOER sets a benchmark for bank lending and borrowing activity, and the ON RRP facility establishes a floor for overnight rates. Ultimately, it is these administered rates and the spread between them that will control overnight money market rates in the FOMC's ample reserves regime and will influence the mix of Federal Reserve liabilities.

I would like to thank SIFMA and the organizers of this event for the opportunity to speak here today. I look forward to the Q&A session, as well as the roundtable on Treasury market structure that follows.