This is taken from the section titled "Fiscal Developments in Puerto Rico: 2012–14" in the full report.

In this report, we discuss the outlook for the sustainability of Puerto Rico’s debt and outline recent Commonwealth efforts to strengthen the Island’s public finances:

- Rising Debt Levels and Market Access Concerns

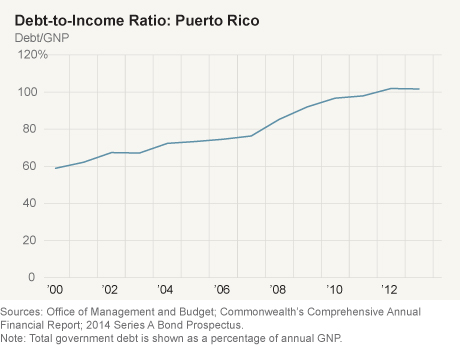

Puerto Rico’s rising debt level and weak economy did not appear to have a major impact on the availability and pricing of public financing for the Commonwealth during the 2000s, but they contributed to analysts’ growing concerns over the sustainability of its fiscal policy. A series of rating downgrades brought the Island’s credit rating to the lowest rung of investment grade by the end of 2012 and eventually to below investment grade in February 2014. The Commonwealth formally lost access to a large portion of its investor base after its debt was downgraded to below investment grade.

Holding only $1.2 billion in liquid assets at the Government Development Bank as of March 2014 and in the face of mounting market concerns about liquidity, the Island successfully reentered the capital markets on March 11 with a $3.5 billion bond issue. However, these bonds were issued at yields above 8 percent—a borrowing cost that would be clearly unsustainable if applied to Puerto Rico’s entire debt load. The success of the bond offering, combined with its high costs, suggests that the Commonwealth retains limited market access.

- Effects of Stress in Puerto Rico on Financial Markets

Some market participants have speculated that ongoing economic or market stress in Puerto Rico could represent a systemic risk to the U.S. municipal market. Thus far, based on market-based measures of stress such as yield spreads, it does not appear that investor concerns regarding Puerto Rico have spread to other municipal borrowers.

Other market participants have suggested that contagion from Puerto Rico’s financial difficulties could spread to other markets through monoline bond insurers. As of this writing, it does appear that events in Puerto Rico have coincided with declines in the share prices of two monoline insurers: Assured Guaranty and MBIA’s National Public Finance Guarantee Corporation.

- Government Efforts to Strengthen Public Finances

Efforts by the Commonwealth government to strengthen Puerto Rico’s fiscal position began well before the Island’s recent fiscal crisis, but have intensified over the past two years. Early responses involved reducing the size of the public-sector workforce over the course of 2007 through 2009—during which government employment fell by about 10 percent, or 40,000 workers—and introducing a fiscal stabilization plan in 2009 designed to reduce government expenditure and increase tax revenues.

More recent efforts to stabilize the fiscal accounts have focused on increasing revenues, expanding the tax base, and controlling expenses with a particular focus on pension reform. On the expenditure side, government department budgets have been reduced and government payrolls remain flat. The Commonwealth’s recently enacted FY 2015 General Fund budget projects a balance. The budget is an important step in the direction of following the government’s stated intention of ending the practice of running central government budget deficits. In addition to seeking to raise revenue, the Commonwealth is currently engaged with external consultants from KPMG who are working with government and private-sector analysts to evaluate the Island’s corporate income, consumer, and property taxes.

Composition of Puerto Rico's Outstanding Debt |

||

|---|---|---|

| Puerto Rico: General Government Debt1 As of December 2013 |

$U.S. Billions |

Percent of Total |

| General Obligation and/or Full Faith and Credit Debt2 | 15.8 | 22.0 |

| COFINA | 15.6 | 21.7 |

| Municipalities and other | 13.2 | 18.4 |

| Tax Revenue Anticipation Notes | 1.1 | 1.5 |

| Public Corporations and Agencies | 26.2 | 36.4 |

| Total | $71.9 | 100.0 |

1In March 2014, Puerto Rico issued $3.5 billion of debt securities. After refinancings and deductions, total debt rose to $72.8 billion.

2Debt payable from revenues from "internal sources," that is, income taxes, is guaranteed by the Puerto Rican constitution.

2012 Debt: Puerto Rico Compared With the States and Washington, D.C. |

||

|---|---|---|

| Percentile of States and D.C. |

(1) Total State/Local Debt, Percent of Aggregate Income |

(2) Federal and State/Local Debt, Percent of Aggregate Income |

| 25th | 13.7% | 83.9% |

| 50th | 16.8% | 94.1% |

| 75th | 19.5% | 100.9% |

| Puerto Rico total debt | 100.7% | 100.7% |

| Puerto Rico rank | 1/52 | 14/52 |

Note: Gross national product is used for Puerto Rico and gross state product for the states and Washington, D.C.

Main | Our Commitment | Where Puerto Rico Stands | Challenges | Developments | Steps

|