- Analysis of topical issues in public policy, financial markets, and the U.S. and global economies. Such projects often culminate in reports or presentations to the Bank’s president and senior management.

- Long-term academic research on a wide range of applied and theoretical topics. Many RAs have the opportunity to coauthor scholarly articles.

- Background in economics, mathematics, statistics, or a related field

- Experience in data analysis and using statistical packages (e.g., R, Stata, Matlab, Julia, SAS, Gauss, TSP, RATS, EViews, PROCSQL), or other computer programming experience (e.g., Java, C++, Python)

- Strong analytical and decision-making abilities and good communication skills

| POSITION | STARTING | DURATION | APPLICATION WINDOW |

| Research Analyst | Summer 2026 | 2 years | Sept. 1 – Oct. 1, 2025 |

| Summer Intern—Junior (expected graduation in Dec 2026 or Spring 2027) |

June 2026 | 10 weeks | Sept. 19 – Oct. 12, 2025 |

| Summer Intern—Sophomore (expected graduation in Dec 2027 or Spring 2028) |

June 2026 | 10 weeks | Sept. 19 – Oct. 5, 2025 |

- Required: Upload Resume/CV and an academic transcript (from the institution you most recently attended/currently attend)

- Optional: Cover letter

- Note: Letters of recommendation will not be considered

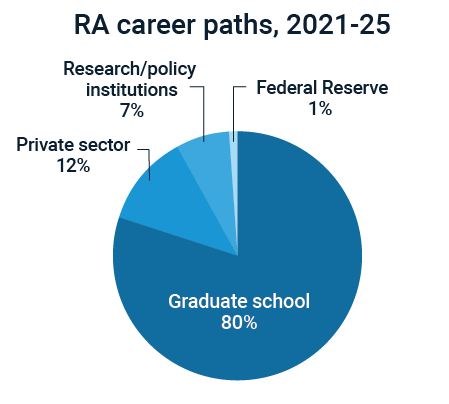

The majority of RAs enter graduate or professional degree programs after leaving the New York Fed. Many pursue a Ph.D. in economics or finance, with recent RAs joining programs in universities such as Berkeley, University of Chicago, Harvard, MIT, Princeton, Stanford, and Yale. Others go on to pursue degrees in business, law, and public policy from leading institutions.

New York Fed RAs also have a strong track record of obtaining fellowships: Eight received fellowships from the National Science Foundation in 2022-25.

Fortune 500 companies and other top employers are seeking the skills and expertise you will gain as an RA. Former RAs have accepted positions at the Bank, while others have become leaders in the business, banking, higher-education, research, and nonprofit sectors.

I joined the New York Fed as an RA after spending two years in economic consulting. As someone curious about graduate school, the RA program helped me make a more informed decision about whether pursuing a career in economic research was the right choice.

The constant interactions with the economists, other RAs, and interns helped me develop a broader and richer understanding of economics and finance research. I greatly strengthened my skills in probability, econometric theory, modeling, and programming as an active participant in a number of research projects regarding banking, financial stability, and asset pricing. I read textbooks and papers, refined and estimated models, and programmed the logic of numerous analyses. I was also able to leverage the tuition assistance program to take additional courses at Columbia University, alongside my work, to strengthen my academic profile.

My experiences as an RA allowed me to become familiar with the ins and outs of the process of doing research in economics, including coming up with a question, writing a model, testing predictions, pivoting directions, and finally culminating in a written paper. The collaborative environment in the program makes it a great place for anyone curious about economic research.

I was most surprised about how much more I matured as an economics researcher and by what I learned about where I still need to mature to get to where I want in my career.

As a senior in college, I had thought of myself as an experienced researcher. I had worked on quite a handful of projects and was prepared to immediately dive into the world of economics research on my own. I have a friend, however, who is three years older than me and had served as both an intern and RA at the New York Fed. He spoke very highly of everything he had learned throughout his years here and convinced me to apply to the RA program instead of applying straight to grad school. I ended up doing so and luckily managed to get an offer from the DSGE team.

Over the past two years I’ve learned an immense amount from the projects and policy products that I’ve worked on, as well as the seminars and classes that I was able to attend. I already feel able to walk into a room of graduate students and match their pace of economics knowledge, which I know will be a big head start when I start grad school myself.

The RA program fundamentally shaped my approach to economic research—from developing policy-relevant research questions to designing empirical strategies to test them. While my time at the New York Fed also helped strengthen my technical skills in various programing languages, what stood out most was the opportunity to contribute to the broader research process. Working closely with economists, I learned how to translate economic intuition, patterns in data, and institutional knowledge into testable empirical hypotheses.

I collaborated with one of my economists on studying the role of financial intermediaries in supporting the surge in small business formation that occurred during and immediately after the COVID-19 pandemic. The project involved cleaning and merging many datasets, which helped me improve my technical skills. More importantly, my economist gave me the intellectual freedom to suggest potential hypotheses and mechanisms to explore in the data. Receiving feedback on my suggestions helped me refine this part of the research process.

Lastly, the research I have contributed to at the New York Fed has been rooted in the institutional details of the financial sector. These details are particularly important for explaining many of the economic outcomes that policymakers care about. I can’t imagine a better place to gain this specific knowledge, which I’m sure will help me develop relevant research questions during graduate school and my future career.

One of the things I’ve enjoyed most about my time at the Bank—first as an intern, and then as an RA—is the wide variety of topics I’ve been exposed to within the field, through both research and policy work. I’ve explored areas such as U.S. dollar security holdings around the globe, bank runs, Treasury and municipal bond market liquidity, and discount window stigma. Through these projects, I’ve seen all stages of the research process, explored a wide range of datasets (including those that I’ve constructed myself), sharpened my coding skills, and become better at organizing projects for effective collaboration.

I’ve also worked on four policy briefings for President John Williams on topics relevant to financial stability, which have allowed me to work with and learn from experts in Markets and Supervision. Being a part of these discussions has given me a deeper appreciation for the value of economic research within the policymaking process and played a huge role in solidifying my decision to go to graduate school. Furthermore, my managers are great mentors, providing advice on day-to-day work and longer-term career goals while also actively encouraging work-life balance.

The research analyst role is incredibly team-oriented, driven by the range of knowledge and backgrounds that exist across the Research floor. Many of the skills I’ve developed have come through working with others—whether on shared projects or through informal interactions.

I work closely with other DSGE RAs, using the New York Fed DSGE model to produce forecasts and counterfactuals to provide insight for FOMC meetings. Most of these efforts are team-based by nature, but we often turn to one another for advice on individual projects.

During my time here, I’ve worked on four policy briefings on topics ranging from the distributional consequences of monetary policy to the role of input/output links in inflation dynamics. Each of these briefings had five or more co-authors, many of them fellow RAs—clear evidence of how collaborative our research is.

In addition, I took a PhD Macroeconomics course at NYU with another DSGE RA to supplement our technical training. We discussed class concepts in the context of our actual work, which helped make the coursework more tangible. A collaborative nature guides most of our interactions and I’m incredibly grateful for the supportive team culture within the Research Group!

Across the Bank, various programs and the economists pour a lot into our development. The tuition assistance program, for example, allowed me to take fully paid-for graduate math courses at my alma mater, Columbia, and helped me further my mathematical skills for understanding theoretical economics. There’s also an RA mentorship program, which pairs each research analyst with an economist whose sole purpose is to guide our experience here and provide support regarding next steps.

Although assignments rotate every six months, connections last. Various economists also elect to teach mini-lecture series to introduce us to, or further our understanding of, foundational and topical knowledge in their fields of economics. I’ve personally benefited from the implicit training we can receive just by casually chatting with any economist on the floor. I have mentors in six of the seven different research departments (I believe!) who have guided me to think more critically about each piece of the academic research process, from refining the econometrics underlying model, to anticipating and addressing counterfactuals to research ideas, to reviewing related literature in fields outside of my niche interests.

Note: Research Analysts' names are in bold.

Rajashri Chakrabarti, Thu Pham, Beckett Pierce, and Maxim Pinkovskiy. “The College Economy: Educational Differences in Labor Market Outcomes,” Liberty Street Economics, May 15.

Nina Boyarchenko, Hyuntae Choi, and Leonardo Elias. “Who Finances Real Sector Lenders?,” Liberty Street Economics, May 12.

Jon Durfee, Michael Junho Lee, Joseph Torregrossa, and Sarah Yu Wang. “Interoperability of Blockchain Systems and the Future of Payments,” Liberty Street Economics, March 27.

Daniel Mangrum and Crystal Wang. “Student Loan Balance and Repayment Trends Since the Pandemic Disruption,” Liberty Street Economics, March 26.

Marco Del Negro, Ibrahima Diagne, Pranay Gundam, Donggyu Lee, and Brian Pacula. “The New York Fed DSGE Model Forecast—March 2025,” Liberty Street Economics, March 21.

Sophia Cho and John C. Williams. “Comparing Apples to Apples: ‘Synthetic Real-Time’ Estimates of R-Star,” Liberty Street Economics, March 3.

Andres Aradillas Fernandez, Martin Hiti, and Asani Sarkar. “Are Nonbank Financial Institutions Systemic?,” Liberty Street Economics, October 1.

Kristian Blickle, Evan Perry, and João A.C. Santos. “Flood Risk Outside Flood Zones,” Liberty Street Economics, September 25.

Gizem Kosar, Davide Melcangi, and Sasha Thomas. “An Update on the Reservation Wages in the SCE Labor Market Survey,” Liberty Street Economics, August 19.

Gara Afonso, Kevin Clark, Brian Gowen, Gabriele La Spada, JC Martinez, Jason Miu, and Will Riordan. “A New Set of Indicators of Reserve Ampleness,” Liberty Street Economics, August 14.

Richard Audoly, Miles Guerin, Giorgio Topa, and Roshie Xing. “The Anatomy of Labor Demand Pre- and Post-Covid,” Liberty Street Economics, August 7.

Rajashri Chakrabarti, Natalia Emanuel, and Ben Lahey. “Racial and Ethnic Inequalities in Household Wealth Persist,” Liberty Street Economics, June 26.

Rajashri Chakrabarti, Dan Garcia and Maxim Pinkovskiy. “Veterans in the Labor Market: 2024 Update,” Liberty Street Economics, May 22.

Martin Almuzara, Babur Kocaoglu and Argia Sbordone. “Is the Recent Inflationary Spike a Global Phenomenon?,” Liberty Street Economics, May 16.

Felix Aidala, Gizem Kosar, and Wilbert van der Klaauw. “The Post-Pandemic Shift in Retirement Expectations in the U.S.,” Liberty Street Economics, May 9.

Fulvia Fringuellotti and Saketh Prazad. “A Retrospective on the Life Insurance Sector after the Failure of Silicon Valley Bank,” Liberty Street Economics, April 10.

Ozge Akinci, Hunter Clark, Jeff Dawson, Matthew Higgins, Silvia Miranda-Agrippino, Ethan Nourbash, and Ramya Nallamotu. “What Happens to U.S. Activity and Inflation if China’s Property Sector Leads to a Crisis?,” Liberty Street Economics, March 26.

Sergey Chernenko, Nathan Kaplan, Asani Sarkar, and David Scharfstein. “Applications or Approvals: What Drives Racial Disparities in the Paycheck Protection Program?,” Staff Reports, no. 1060, May.

Alena Kang-Landsberg, Stephan Luck, and Matthew Plosser. “Deposit Betas: Up, Up, and Away?,” Liberty Street Economics, April 11.

Gara Afonso, Marco Cipriani, Catherine Huang, Abduelwahab Hussein, and Gabriele La Spada. “Monetary Policy Transmission and the Size of the Money Market Fund Industry: An Update,” Liberty Street Economics, April 3.

Mary Amiti, Sebastian Heise, Giorgio Topa, and Julia Wu. “What Has Driven the Labor Force Participation Gap since February 2020?,” Liberty Street Economics, March 30.

Erica Bucchieri, Jacob Conway, Jack Glaser, and Matthew Plosser. “Does the CRA Increase Household Access to Credit?,” Liberty Street Economics, February 27.

Daniel J. Lewis, Davide Melcangi, Laura Pilossoph, and Aidan Toner-Rodgers. 2023. “Approximating Grouped Fixed Effects Estimation via Fuzzy Clustering Regression,” Journal of Applied Econometrics, 38, no. 7: 1077-84.

Marco Del Negro, Marc P. Giannoni, and Christina Patterson. 2023. “The Forward Guidance Puzzle,” Journal of Political Economy Macroeconomics 1, no. 1 (March): 43–79.

Michael Fleming, Giang Nguyen, and Francisco Ruela. 2023. “Tick Size, Competition for Liquidity Provision, and Price Discovery: Evidence from the U.S. Treasury Market,” Management Science (January).

Kenechukwu Anadu, Ryan M. Craver, and Gabriele La Spada. 2022. “The Money Market Mutual Fund Liquidity Facility,” Economic Policy Review 28, no. 1 (June).

Nicola Cetorelli, Michael Jacobides, and Sam Stern. 2021. “Mapping a Sector's Scope Transformation and the Value of Following the Evolving Core,” Strategic Management Journal 42, no. 12 (December): 2294-2327.

Rajashri Chakrabarti and Max Livingston. 2021. “Tough Choices: New Jersey Schools during the Great Recession and Beyond.” Economic Policy Review 27, no. 1 (July).

Michael Cai, Marco Del Negro, Edward Herbst, Ethan Matlin, Reca Sarfati, and Frank Schorfheide. 2021. “Online Estimation of DSGE Models.” The Econometrics Journal 24, no.1 (January): C33-C58.

Linda Goldberg and April Meehl. 2020. “ Complexity in Large U.S. Banks.” Economic Policy Review 26, no. 2. (March).

Michael Cai, Marco Del Negro, Marc Giannoni, Abhi Gupta, Pearl Li, and Erica Moszkowski. 2019. “DSGE Forecasts of the Lost Recovery.” International Journal of Forecasting 35, no. 4 (October-December): 1770-89.

Jacob Adenbaum, Adam Copeland, and John J. Stevens. 2019. “Do Long-Haul Truckers Undervalue Future Fuel Savings?” Energy Economics 81 (June):1148-66.

Michael Abrahams, Tobias Adrian, Emanuel Moench and Rui Yu. 2016. “Decomposing Real and Nominal Yield Curves.” Journal of Monetary Economics 84 (December): 182-200.

Meta Brown, John Grigsby, Wilbert van der Klaauw, Jaya Wen, and Basit Zafar. 2016. “Financial Education and the Debt Behavior of the Young,” The Review of Financial Studies 29, no. 9 (September): 2490-522.

Brandyn Bok, Daniele Caratelli, Domenico Giannone, Argia Sbordone, and Andrea Tambalotti. 2018. “Macroeconomic Nowcasting and Forecasting with Big Data,” Annual Review of Economics, 10, no. 1 (August): 615-43.

Joshua Abel, Robert Rich, Joseph Song, and Joseph Tracy. 2016. “The Measurement and Behavior of Uncertainty: Evidence from the ECB Survey of Professional Forecasters,” Journal of Applied Econometrics 31, no. 3 (April-May): 533-50.

Directions

E-mail us

More about Benefits

The Tuition Assistance Program has enabled RAs to:

- Earn a master’s degree in statistics (Columbia University) while working at the Bank

- Participate in other degree and certificate programs (New York University and Columbia University)

- Take individual graduate-level classes such as stochastic calculus, probability, statistics, real analysis, linear regression models, time series regression, linear algebra, continuous-time finance, derivative securities, graph theory, and partial differential equations.

More about the Undergraduate Summer Analyst Program

- “My favorite aspect of living/working in NYC is the wealth of access to things to do in the city! You hear all the time about how lively the city is but experiencing it first-hand was a welcome surprise.” – Roshie Xing, Research Analyst

- “All of New York's transit system is centered around FiDi: that means the whole city is accessible after work, but it also means you have extremely high flexibility for where to live since there are so many easy commutes.” – Nish Sinha, Research Analyst

- “My favorite aspect of working in New York City is how interconnected everything is. There is an entire universe of possibilities that are all available without needing a car.” – Jacob Kim-Sherman, Research Analyst

- “I’m surprised by how quiet NYC can be. I now live right next to Prospect Park, which has several expanses of fields that are peaceful (except on weekends).” – William Zeng, Research Analyst

Thinking of Pursuing a PhD in Economics? Info on Graduate School and Beyond

Thinking of Pursuing a PhD in Economics? Info on Graduate School and Beyond

Follow us @NYFedResearch for our economists’ latest research and policy analysis.

Follow us @NYFedResearch for our economists’ latest research and policy analysis.